Nail Tech Insurance

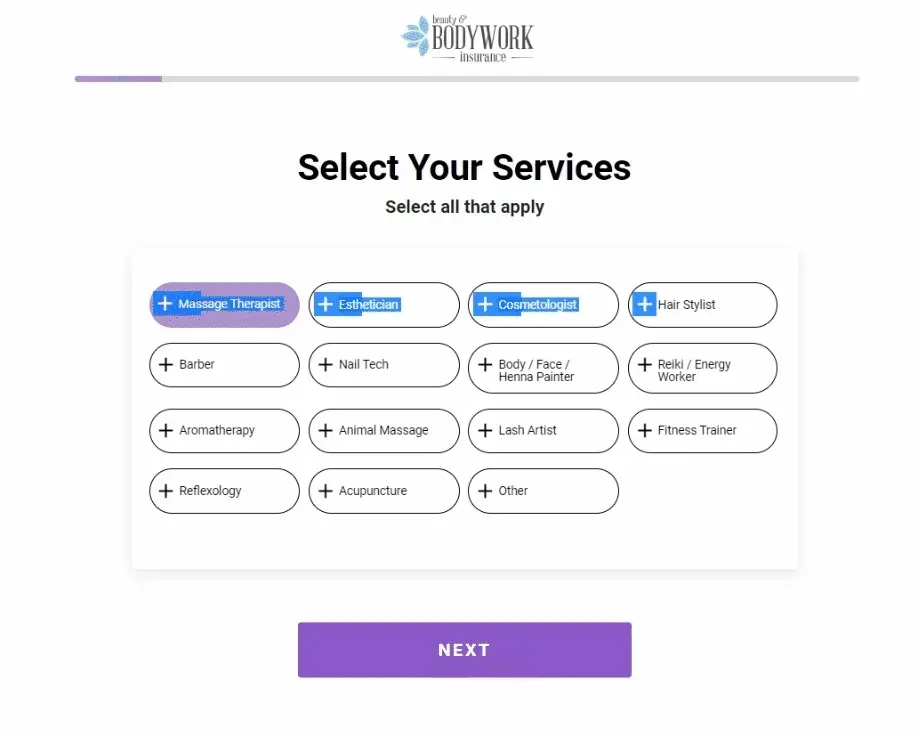

- One policy for all your services

- Instant coverage + proof of insurance

- $15 additional insureds | $30 unlimited

- Mobile coverage for wherever you work

Starting at $9.99/month or $96/year

Deep Tissue Massage Insurance From BBI

Beauty & Bodywork Insurance (BBI) is the best choice for protecting your artistry.

Affordable

A policy priced with your budget in mind.

Comprehensive

All the coverage you need, tailored just for your industry.

Supportive

Customer service that’s here for you now and later.

Common Nail Tech Insurance Questions

What is Nail Tech Insurance?

Nail tech insurance is coverage designed to keep you from paying out of pocket for costly claims involving your business. When clients get hurt by your tools or when someone trips over a nail drill cord, insurance can cover their medical bills, legal fees, and more.

Think of nail tech insurance as a protective topcoat for your business, keeping you safe from the risks of your line of work.

At BBI, we know you’d rather focus on creating that perfect manicure. That’s why our comprehensive nail tech insurance policy includes general and professional liability coverage, with options for add-ons, to give you peace of mind to work confidently.

Why Do Nail Technicians Need Insurance?

Even the most experienced nail techs can make mistakes. Add in sharp tools, ingredient-heavy products, and water-filled pedi basins – a lot can go wrong. You need nail tech liability insurance to cover you for all the what-ifs.

Also, most nail salon owners will require you to carry insurance and list them as additional insureds on your policy, before even considering you as a contractor. BBI makes it easy for you to meet these requirements and get to booking clients!

Focus on your artistry with essential coverage from BBI.

How Much Does Insurance for Nail Techs Cost?

BBI’s nail tech insurance starts at just $9.99/month or $96/year. Because we specialize in insuring solely your industry, we’re able to offer you one of the most affordable policies on the market.

For an additional cost, enhance your policy with optional coverages to fit your business needs. You pay only for what you need – nothing more!

We’ll Take It From Here

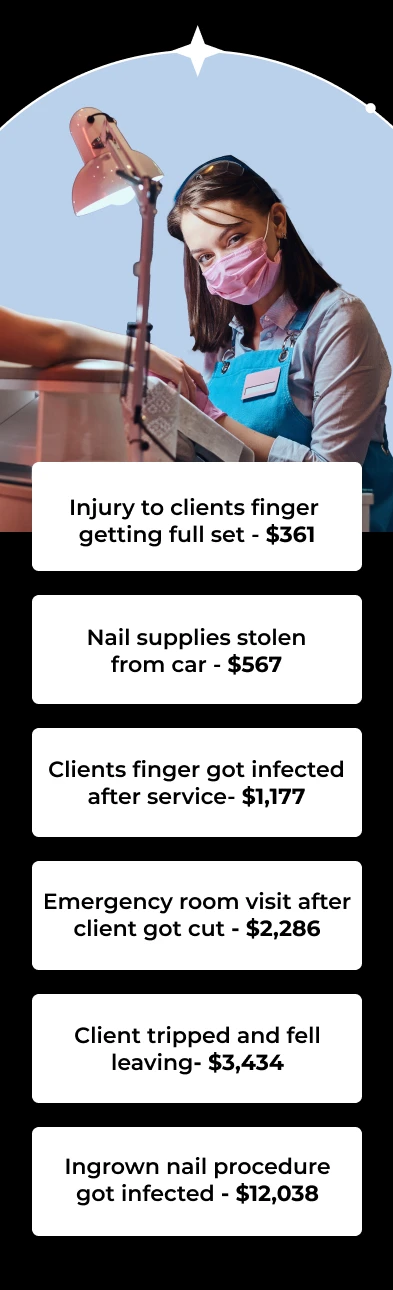

Accidents happen – even to professionals. BBI’s got you covered for claims like these:

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

Accidents happen – even to professionals. BBI’s got you covered for claims like these:

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

Quote-Free Nail Tech Insurance

Join over 63,000 professionals, including nail techs just like you, who have found peace of mind with BBI’s liability coverage.

General and Professional Liability Limits

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business and professional services.

$3,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold or distributed.

$3,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

-False Arrest, detention or imprisonment

-Malicious prosecution

-Wrongful Eviction or Wrongful Entry

-Oral or written publications that slander or libels a person or organization

-Oral or written publication or material that violates a person’s right of privacy

-The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

Any One Person: $5,000

i. Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions. If you would like to see a sample policy, please contact us.

Optional Add-Ons

Your policy comes standard with the coverage listed in the chart above. To perfect your nail tech insurance policy, choose from these optional add-ons:

$2/month + options for more coverage

Tools and supplies coverage, or inland marine, can pay to replace your movable business essentials if they get damaged or stolen.

Good for: covering your nail tools, products, business tablet, and more.

$15/year | one additional insured

$30/year | unlimited additional insureds

Adding additional insureds extends your policy coverage to qualified third parties you add to your policy that may be affected by claims brought against your business.

Good for: meeting the requirements of salon or spa owners, landlords, venue organizers, and more.

$6.58 / month

Cyber liability coverage can pay for claims arising from data breaches and cyber attacks on your business.

Good for: nail techs who book clients or accept payments online.

Other Common Nail Tech Insurance Coverage Questions

Can Nail Tech Insurance Cover Mobile Services?

Yes, your BBI nail technician insurance travels with you wherever you work (Missouri excluded)! From the salon to your client’s home, your business is covered.

Are There Any Exclusions in Nail Tech Insurance Policies?

BBI’s nail tech insurance policy covers most common nail services, however, some beauty treatments are excluded. Check out our list of excluded methods to make sure our policy is a good fit for your business.

What Should Be Considered When Choosing a Nail Tech Liability Insurance Policy?

When choosing your nail tech insurance policy, consider pricing, coverage, customer service, as well as any of your business’ specific needs. BBI offers excellent-rated coverage at an affordable price, with customer-approved support (real humans!) who are ready to help you.

See why we’re confident you’ll love being insured with us: Why BBI?

You're in Great Hands

See what our happy policyholders have to say.

Great comprehensive coverage that conforms to the needs of the home office, studio, atelier and business while also considering health, employees and auto. Great buy! I recommend it to everyone because it’s a very affordable insurance that can be molded to the business’ complexity or simplicity. Amazing!

Working for the first time in three years, I asked a friend about insurance, she highly recommended Beauty & Body work , it was a great site, easy to understand and lots of follow up. Im happy to be working again!

Easy peasy, I think about 6 minutes is all it took and immediately. I had my proof of insurance!

So at ease knowing I have insurance on my new Lash business and it was easy to apply.

Super fast online purchase for my esthetician business...Had a few questions before I purchased spoke with a very helpful associate that doesn't work on commission.

So happy I found Beauty & Bodywork Insurance. The process to insure my spray tanning business was seamless and affordable. Just what I needed!