What Is Cyber Liability Insurance?

As a beauty and bodywork professional, you might spend more time working with your hands than with technology. However, if your job requires you to store any kind of client information—like names, payment information, birthdays, or more—then you could stand to lose a lot if your technology is compromised by hackers.

BBI’s cyber liability insurance protects your business and your reputation in the event of a data breach in which your customers’ personal information is exposed or stolen by a hacker or other criminal who has gained access to your electronic network.

What Does Cyber Insurance Cover?

BBI’s cyber liability insurance is designed to protect you in case hackers or unauthorized users gain access to sensitive client information stored on any of your business devices like phones, laptops, servers etc.

These bad actors can do things like:

- Open fraudulent credit card accounts

- Access email accounts or other sensitive correspondence

- Make fraudulent payments

- Even find your clients’ real-world addresses or other identifying information

If your clients’ personal data or payment information is compromised, you can be held liable for any damages or financial losses they encounter. With cyber liability insurance, you’re protected for claims up to $100,000 for only $79 per year!

Who Needs Cyber Liability Insurance?

In short—pretty much everyone! Salons or spas that are reliant on internal software to schedule clients or handle payments can store the personally identifiable information of hundreds of clients, making them a prime target for hackers. Even sole practitioners that use automatic card readers or calendar apps are still potentially liable for any data breaches. Small businesses especially might lack the resources to devote to cyber security, making them less able to prevent cyber attacks in the first place, and less able to pay for any resulting damages.

How Much does cyber insurance cost?

BBI’s cyber insurance can be added to your base policy for an additional $79, which is due at the time of purchase. Coverage is active for one year from the purchase date. You also have the option to select the monthly coverage option, meaning you can get protection for just $6.58 per month!

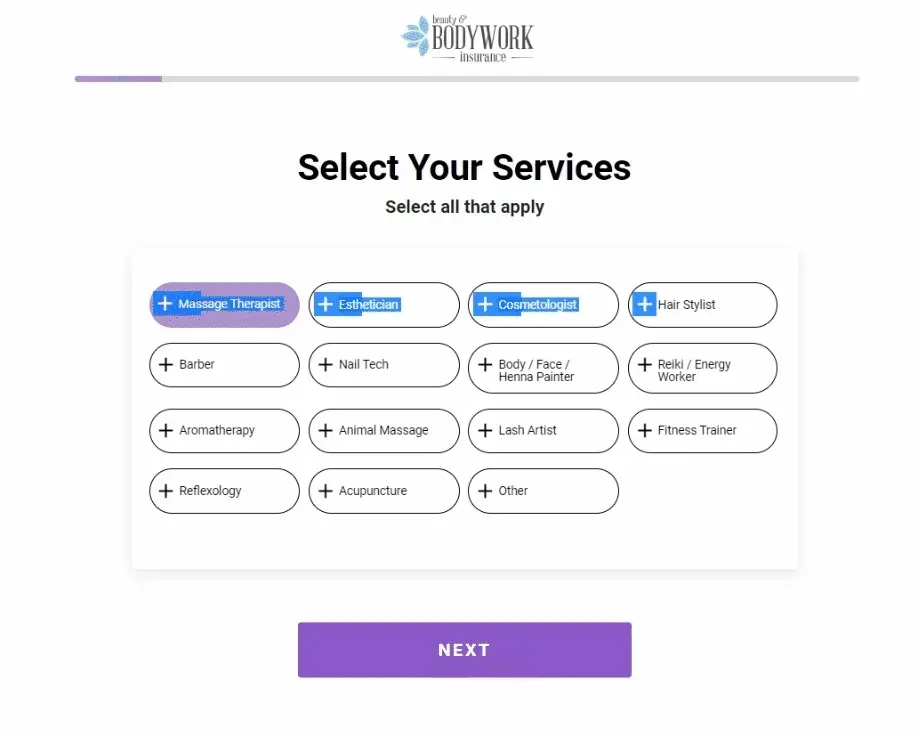

How to Purchase Cyber Liability Insurance

BBI Makes it easy to get cyber liability insurance! Start by filling out an application and simply select the “cyber liability insurance” option from the list of optional coverage. If you are an existing policy holder, you can add cyber liability coverage at any time.

- Log in to your customer dashboard

- Select “Change policy options” and select Cyber Coverage option

- Checkout and pay

Chris Graham, customer service rep, is here to help!

Common Questions About Cyber Liability Insurance for Beauty and Bodywork Professionals

Why Do I Need Cyber Liability Insurance?

Cyber liability insurance is a safeguard against the potential dangers of doing business in the digital age. When many small businesses turn to third-party apps, software, and devices to schedule appointments, store client profiles, and fulfill digital payments, this client information is a potential target for hackers and criminals.

When these hackers obtain your clients’ information, they can use it to commit fraudulent purchases, compromise their digital footprint, or otherwise cause real harm. If a client names you in a lawsuit alleging that you failed to secure their information, cyber insurance can protect your business by paying for any damages that would otherwise come out of your pocket.

What Are Some Examples of Cyber Liability Claims?

Say you’re a massage therapist and you leave your laptop which you use to schedule all of your appointments at a local coffee shop and someone finds it. That person accesses your client’s files and sends them a fraudulent email asking for additional payment for your services, but routes the money to their own account. In this scenario, you could be held liable for the additional payment.

In another case, say you are a hairdresser who keeps all of your clients credit card information on your phone to help bill them more easily. After responding to a suspicious email, you later learn that your phone was externally accessed and a hacker received your client’s credit card information and made a series of fraudulent charges. You could be liable for the initial purchases the hacker made, as well as any potential further harm done to your client stemming from the data breach.

Is Cyber Liability Insurance Worth It?

Absolutely! It’s estimated that nearly one in four businesses has experienced a cybersecurity event in the form of an attempted breach or a successful one. With small businesses and independent contractors being especially vulnerable, cyber liability insurance can provide peace of mind knowing that your clients are protected, and a way to help them recoup their losses if the worst should happen.

Ready to be Digitally Secure?

Don’t let the digital tools of your business become a potential source of liability in the wrong hands. With cyber insurance from BBI, you can keep your business connected while keeping your clients and your bottom line safe.