Tools and Supplies Coverage

What Is Inland Marine Insurance?

Inland Marine insurance, also known as tools and supplies coverage, is designed to protect the business property, tools, supplies, and inventory that are essential to your business operations. Despite its name, Inland Marine insurance doesn’t solely cover assets transported over water (marine) but rather focuses on items that are stored or transported on land.

What does Inland Marine Insurance cover?

Inland Marine insurance coverage provides coverage for anything that is standard and customary to your industry. It offers protection for movable property, tools, supplies, and inventory that are crucial to your operations. For a beauty professional, this could include dryers, tables, warmers, chairs, kits and sets, bowls, lights, specialty tools, and more! It would not cover anything that is permanently attached to or part of the physical structure such as sinks.

Here are a few examples of the types of items typically covered by Inland Marine insurance:

Raw Materials

Whether you create your own sugar scrubs and lotions from scratch or require raw materials for production, Inland Marine insurance can protect these materials against damage, theft, or loss.

Property in Transit

Tools and equipment coverage covers property while it is being transported from one location to another. Whether you’re shipping wax melting pots or massage chairs, this coverage ensures that your property is protected against damage, theft, or loss during transit.

Booth, Vendor & Exhibition Supplies

For beauty professionals that participate in industry trade shows, exhibitions, or events, Inland Marine insurance can cover the supplies, displays, and equipment used in these settings. This includes protection against accidental damage, theft, or loss that may occur during setup, dismantling, or while at the event.

Special Event Equipment

If your beauty business involves organizing or providing equipment for special events such as weddings, conferences, or concerts, Inland Marine insurance can offer coverage for these items. This includes protection against damage, theft, or loss of equipment during the event or while in transit.

In-store or Mobile Payment Systems

Inland Marine insurance can also cover electronic payment systems used in your business, whether they are fixed in-store or mobile for on-the-go transactions. This coverage protects against damage, theft, or loss of these valuable systems.

Electronics

Computers, tablets, televisions, video equipment, sound systems, and other electronics used in your salon or esthetician booth can be covered by Inland Marine insurance. This protection extends to both in-store equipment and portable devices used for business purposes.

Tables, Tools, and Products Used to Deliver a Service

Miscellaneous Business Gear

In addition to the specific examples mentioned above, Inland Marine insurance can also provide coverage for various other business gear. This includes items such as tanning sprayers (machinery), electric nail files (specialized instruments), work phones (communication devices), and other valuable assets essential to your business operations.

Who Needs Inland Marine Insurance?

If you’re a massage therapist, esthetician, cosmetologist, nail technician, salon and spa owner, or other beauty professional who has any business equipment, then you need Inland Marine insurance.

How Much Does Tools And Equipment Coverage Cost?

We believe that protecting your equipment should be affordable. Our tools and equipment coverage tiers start at just $2/month and offer up to $10,000 in aggregate coverage limits. Get protection for your brushes, facial beds, technician stools, steamers, wax warmers, carts, hot towel cabinets, and more. A deductible applies per occurrence.

How Can I Purchase Inland Marine Insurance?

Purchasing Inland Marine insurance is quick and easy. You can purchase tools and equipment coverage in two different ways.

- Add Inland Marine insurance while filling out the Beauty and Bodywork Insurance application.

- Add Inland Marine insurance through your user dashboard at any time.

Tools and Supplies Coverage Tiers

Limits – Per Claim / Per Policy | Price | Deductible | |

Tier 1 | $2,000 / $2,000 | $2/month | $100 |

Tier 2 | $5,000 / $10,000 | $5.50/month | $200 |

Tier 1:

Limits – Per Claim/Per Policy:

$2,000 / $2,000

Price:

$2/month

Deductible:

$100

Tier 2:

Limits – Per Claim/Per Policy:

$5,000 / $10,000

Price:

$5.50/month

Deductible:

$200

How can Inland Marine Insurance help your business?

Inland Marine insurance offers several key benefits that can help safeguard your beauty business assets and support your operations:

Comprehensive Protection

By securing Inland Marine insurance, you ensure that your valuable beauty tools, equipment, and inventory are protected against various risks, including theft, damage, vandalism, and other unforeseen incidents. This coverage provides financial support for repairing or replacing these assets, minimizing the impact on your business.

Flexibility and Customization

Inland Marine insurance policies can be tailored to suit the unique needs of your beauty business. Whether you operate in the creation of esthetician-used creams, transportation of massage tables, or any other industry, coverage can be customized to address the specific risks and challenges you face, ensuring that your assets are adequately protected.

Business Continuity

If an unforeseen event, such as a fire, theft, or natural disaster, causes damage or loss to your business assets, Inland Marine insurance can help expedite your recovery process. With the financial support provided by the policy, you can replace damaged equipment, replenish inventory, and resume operations more quickly, minimizing downtime and potential loss of revenue.

Peace of Mind

By having Inland Marine insurance in place, you gain peace of mind knowing that your beauty business supplies are covered. This confidence allows you to focus on running and growing your business without the constant worry of potential asset-related setbacks.

Why Do I Need Coverage For My Tools?

Without adequate coverage for your tools and supplies, your beauty business is exposed to a host of potential risks that can have devastating consequences. From damage and theft to loss due to unforeseen events, the impact on your operations and bottom line can be significant. Protecting your business assets with Tools and Supplies insurance is not just an option – it’s a crucial safety net for your business.

Every day, businesses like yours face the reality of unexpected incidents that can disrupt operations and lead to financial loss. Consider the following potential risks.

Damage

Accidents can happen at any time, whether it’s a fire, a water leak, or a mishap during transportation. Without the right coverage, the cost of repairing or replacing damaged tools and supplies can be a heavy burden on your business.

Theft

Unfortunately, theft is a prevalent threat in today’s world. Valuable tools and supplies are prime targets for thieves looking to make a quick profit. If your business falls victim to theft, the financial and operational consequences can be overwhelming.

Loss Due to Unforeseen Events

Natural disasters, such as wind and rain can cause widespread damage and disruption. In such events, the loss of tools, supplies, and inventory can have a severe impact on your ability to serve customers and generate revenue.

Product Liability Lawsuit

Imagine a scenario where a customer claims that a product used on them by a technician caused them harm or injury. In such cases, the customer may file a product liability lawsuit against your business, seeking compensation for medical expenses, pain and suffering, and other damages. Legal fees, settlement costs, or court-awarded judgments in product liability cases can easily reach tens or hundreds of thousands of dollars, depending on the severity of the alleged harm and the size of your business.

Negligence Lawsuit

Consider a situation where a client or customer suffers an injury on your business premises due to unsafe conditions or negligent actions. They may file a negligence lawsuit, holding your business responsible for their injuries and seeking compensation for medical expenses, lost wages, and other damages. Legal fees, settlements, or court judgments in negligence cases can quickly add up, potentially costing your business thousands or even millions of dollars.

Breach of Contract Lawsuit

In certain industries, businesses enter into contracts with clients or suppliers. If your business fails to fulfill its contractual obligations or breaches the terms of the agreement, the affected party may file a breach of contract lawsuit seeking financial restitution. Legal fees, settlement costs, or court-ordered damages in breach of contract cases can vary widely depending on the specifics of the contract and the financial impact on the aggrieved party.

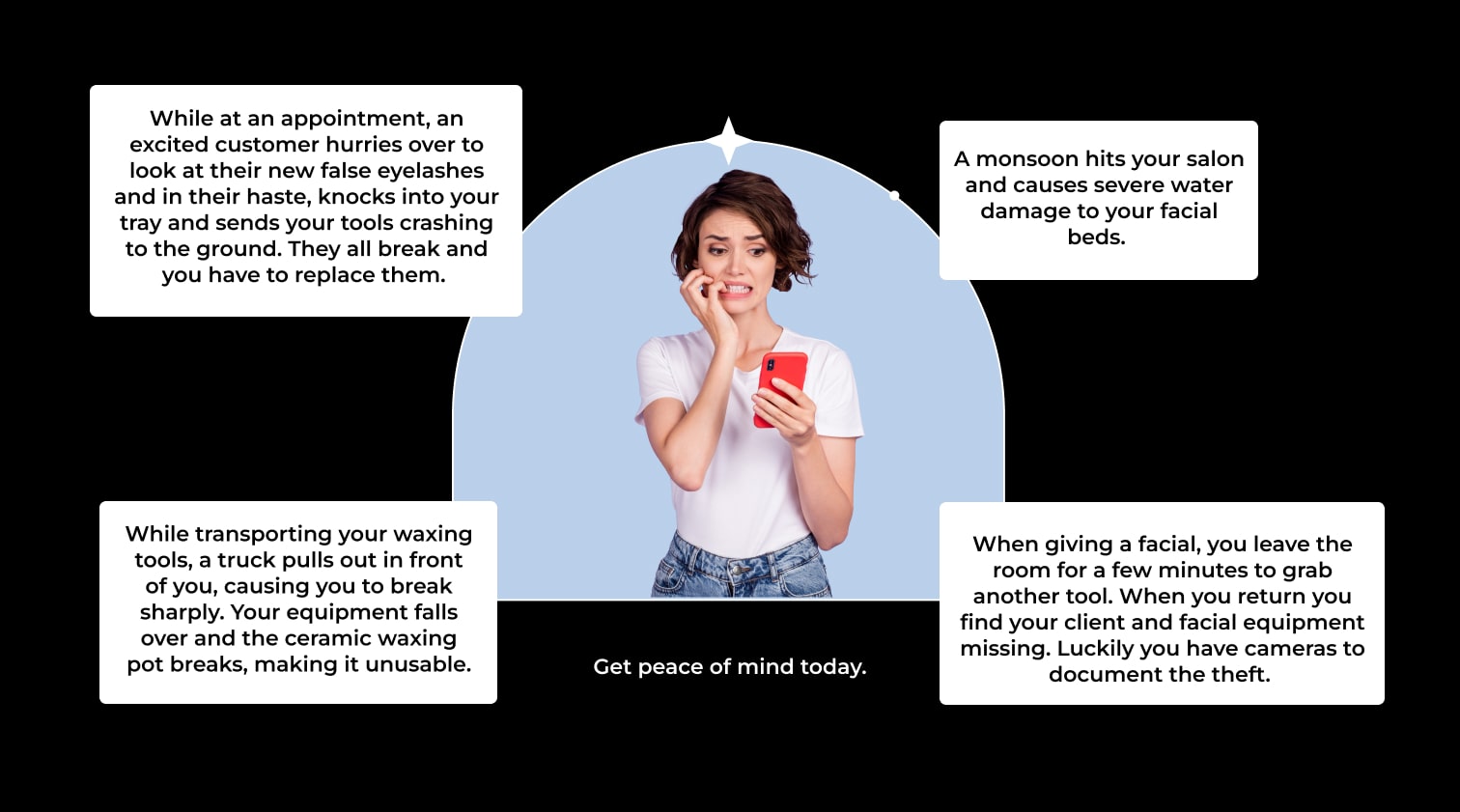

Examples Of Inland Marine Claims

Listed below are a few examples of tools and equipment insurance claims.

Listed below are a few examples of tools and equipment insurance claims.

Safeguard Your Business Today

Protect your tools, supplies, and business assets with Tools and Supplies insurance. Don’t leave your business vulnerable to potential risks, lawsuits, and financial burdens. Protect your beauty business today!

You're in good hands.

Here’s what other people have to say about their experience from over 420+ available reviews.

Great comprehensive coverage that conforms to the needs of the home office, studio, atelier and business while also considering health, employees and auto. Great buy! I recommend it to everyone because it’s a very affordable insurance that can be molded to the business’ complexity or simplicity. Amazing!

Working for the first time in three years, I asked a friend about insurance, she highly recommended Beauty & Body work , it was a great site, easy to understand and lots of follow up. Im happy to be working again!

Easy peasy, I think about 6 minutes is all it took and immediately. I had my proof of insurance!

So at ease knowing I have insurance on my new Lash business and it was easy to apply.

Super fast online purchase for my esthetician business...Had a few questions before I purchased spoke with a very helpful associate that doesn't work on commission.

So happy I found Beauty & Bodywork Insurance. The process to insure my spray tanning business was seamless and affordable. Just what I needed!