What are Beauty Insurance Claims Examples?

Whether you’re looking to get insurance because it’s required or you’re worried about the risks that come with being a beauty professional, you want to make sure your insurance works when you need it most – if you ever need to file a claim. Here are a few instances we’ve supported and helped professionals like you in their time of need.

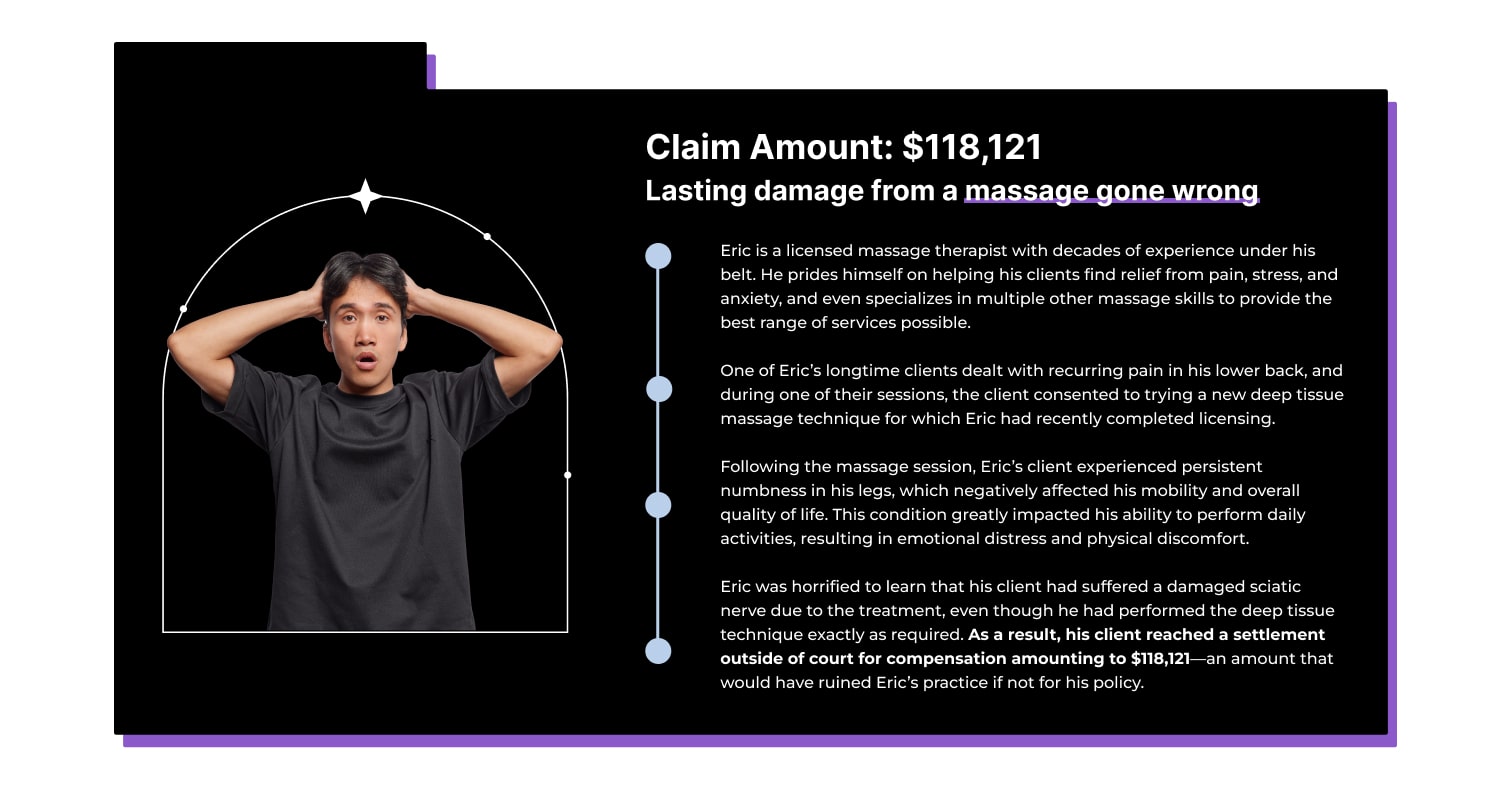

Claims Other Beauty Professionals Have Filed with BBI*

*All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

Relax, BBI's Got You Covered

Without insurance, each one of the bodywork professionals would have had to pay huge sums in damages and face devastating consequences to their business’ reputation—something a small business can’t always afford. With BBI, your business can be protected from scenarios like this with services like:

Yearly Policy Limit: $3 million (included)

Insurance for beauty & bodywork professionals includes general and professional liability insurance that offers third-party bodily injury and property damage coverage. Sometimes you slip up. Sometimes clients just slip. This coverage protects you if someone else is harmed or property is damaged while you’re working. It also protects you if a client injures themself after taking your advice.

Yearly Policy Limit: $3 million (included)

As a part of your business, you might use products like hair coloring, massage oils, or makeup kits. This coverage protects you if they end up harming the client in any way. It also protects you if something happens after you finish your service. For instance, if a client complains of neck pain after a deep tissue massage and blames you.

Yearly Policy Limit: $300,000 (included)

Mostly intended for short-term protection, this coverage helps cover costs of damage to premises you occupy for 7 days or less. It differs from General Liability in that it covers you regardless of cause. Say an accident happens while you’re moving in and setting up – this coverage would kick in. It also applies to fire damage.

Yearly Policy Limit: $2,000-$10,000 (optional addition)

Also known as Inland Marine Insurance, Tools & Supplies coverage protects and pays for tools, supplies, and inventory that suffer damage or theft. This includes but is not limited to massage/manicure tables, massage/barber/pedicure chairs, hair/nail dryers, lotion/gel/stone warmers, etc. Structural properties like buildings or items permanently attached to properties are excluded.

Get Protected Now

Don’t let your business become one of these cautionary tales. Buy a policy now and find the coverage that makes a difference when you need it the most.