Bodyworker Insurance

As a professional bodyworker, you try to create the perfect atmosphere for your clients. Performing specialized treatments requires technique and attention to detail. While you may be a skilled bodyworker, obtaining bodywork insurance protects you and your business in case an accident does occur during the client’s appointment.

Fast & Secure Online Purchase

Buy Today & Get Immediate Coverage

Download Proof of Insurance at Checkout

$15 per Additional Insured or $30 for Unlimited

BBI Is the Coverage You Need

There are risks associated with body work. For example, a client could have an adverse reaction to a cream applied to their body, or an individual could slip and fall and crack their head open in your spa. These could be instances where you would be held liable and be forced to pay the client’s medical bills.

While it is impossible to prevent every mishap, you can prepare by purchasing bodyworker insurance. Here at Beauty & Bodywork Insurance (BBI), our goal is to provide you with the most liability coverage at the best price.

- Backed by top-rated carriers

- One policy for all of your services

- Easy, affordable, and 100% online

- Monthly or annual payment options

- Multiple tools and equipment coverage tiers

- Industry-preferred occurrence-based coverage*

- Goes where you go — from spa to mobile service!

*If you purchased your policy after July 1, 2024, your policy is an occurrence-based policy. If you purchased or renewed your policy before July 1, 2024, your policy is a claims-made policy and is eligible to become an occurrence-based policy after July 1, 2025.

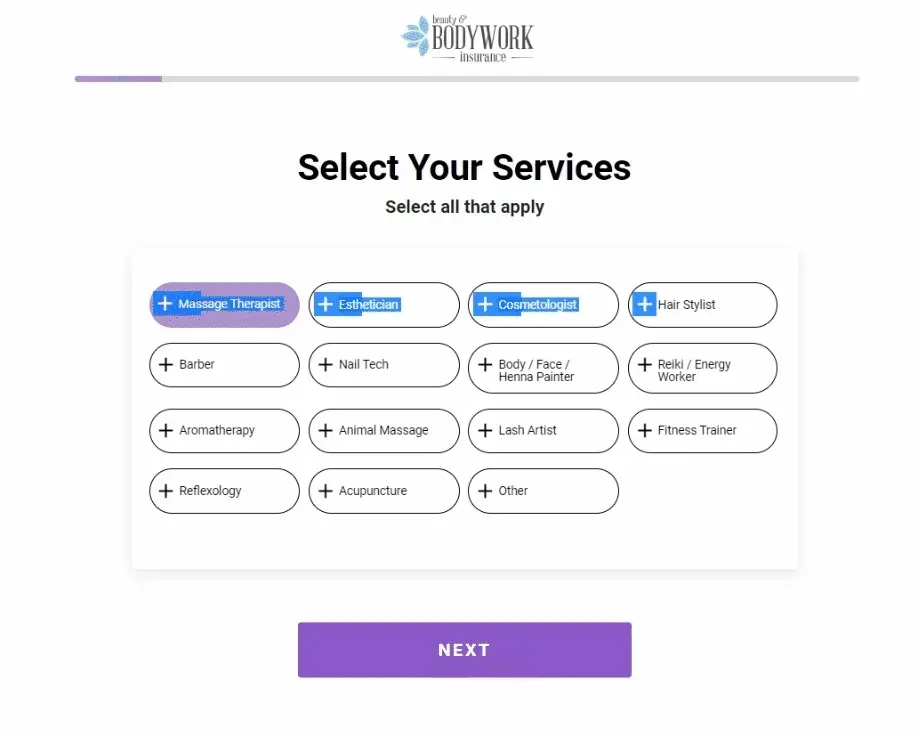

What Services Are Covered in a BBI Bodyworker Policy?

BBI covers a wide variety of services. Take a look at this list to see what we cover:

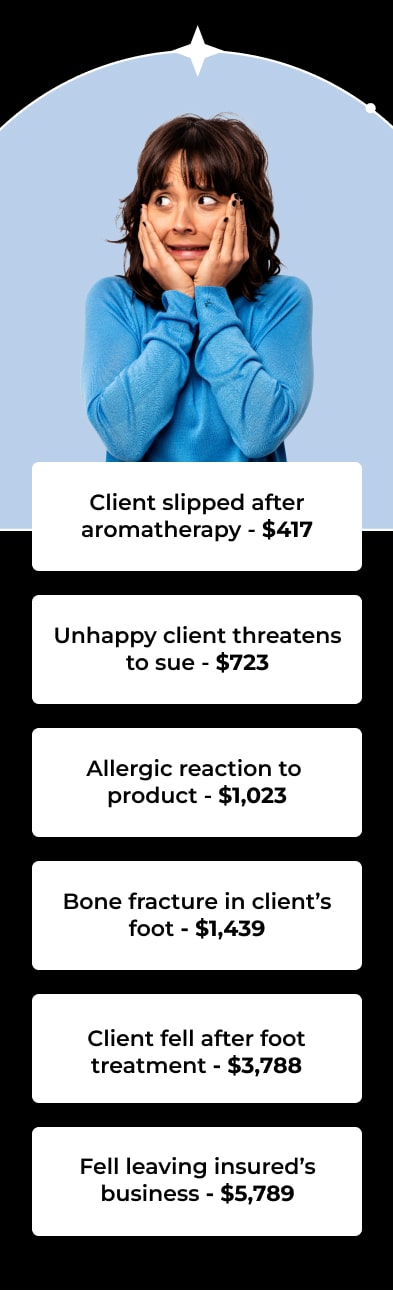

What Are Some Examples Of Covered Claims?

While each policy has coverage specifics, here are some actual claim examples that BBI has covered. Without bodyworker insurance coverage, you could be held liable for these claims.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

While each policy has coverage specifics, here are some actual claim examples that BBI has covered. Without bodyworker insurance coverage, you could be held liable for these claims.

All policies have conditions, limitations, and exclusions, please read the policy for exact verbiage. Claim scenario circumstances vary in nature and similar claims do not guarantee coverage. You could be held liable for any damage done to your client. Make sure that you are aware of any allergies that your clients may have beforehand, and always work with precautions and care.

Quote-Free Application Process Bodyworker Insurance

Join the tens of thousands of bodyworkers nationwide who have found peace of mind by purchasing liability coverage from BBI. Get a policy today!

General and Professional Liability Limits

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business and professional services.

$3,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold or distributed.

$3,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

-False Arrest, detention or imprisonment

-Malicious prosecution

-Wrongful Eviction or Wrongful Entry

-Oral or written publications that slander or libels a person or organization

-Oral or written publication or material that violates a person’s right of privacy

-The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

Any One Person: $5,000

i. Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions. If you would like to see a sample policy, please contact us.

You're in good hands.

Here’s what other people have to say about their experience.

Great comprehensive coverage that conforms to the needs of the home office, studio, atelier and business while also considering health, employees and auto. Great buy! I recommend it to everyone because it’s a very affordable insurance that can be molded to the business’ complexity or simplicity. Amazing!

Working for the first time in three years, I asked a friend about insurance, she highly recommended Beauty & Body work , it was a great site, easy to understand and lots of follow up. Im happy to be working again!

Easy peasy, I think about 6 minutes is all it took and immediately. I had my proof of insurance!

So at ease knowing I have insurance on my new Lash business and it was easy to apply.

Super fast online purchase for my esthetician business...Had a few questions before I purchased spoke with a very helpful associate that doesn't work on commission.

So happy I found Beauty & Bodywork Insurance. The process to insure my spray tanning business was seamless and affordable. Just what I needed!