Booth Renters Insurance

Benefits of Insurance for Salon Booth Renters

Affordable

A policy priced with your budget in mind.

Comprehensive

All the coverage you need, tailored just for your industry.

Supportive

Customer service that’s here for you now and later.

What Is Booth Renters Insurance?

Booth renters insurance, or beauty salon chair insurance, is business liability coverage designed for independent beauty professionals who rent space at a salon or spa.

You’ve created a workspace that’s all you. Protect it with top-rated booth rental insurance from Beauty & Bodywork Insurance (BBI) today!

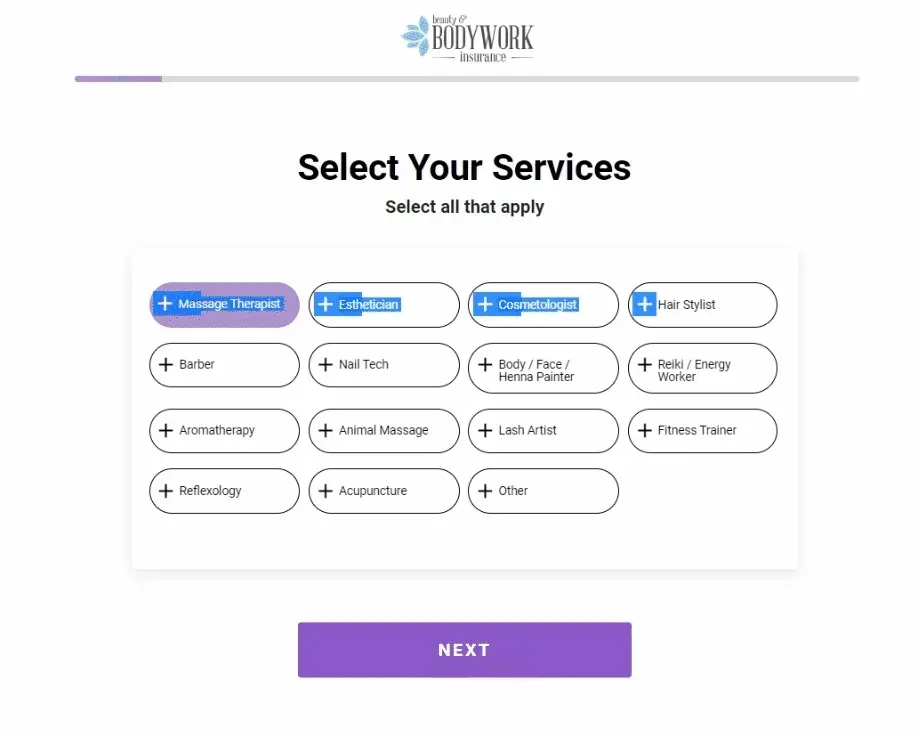

Who Needs Booth Rental Insurance?

Any beauty professional who rents a booth or chair from a beauty venue can benefit from carrying liability insurance. Here are some common professions that opt for this coverage:

- Barbers

- Nail techs

- Lash techs

- Hair stylists

- Estheticians

- Makeup artists

- Cosmetologists

- Massage therapists

- Plus more!

Booth rental insurance is not for salon or spa owners. If that’s you, check out our salon and spa insurance coverage.

Why Do I Need Insurance to Rent a Salon Station?

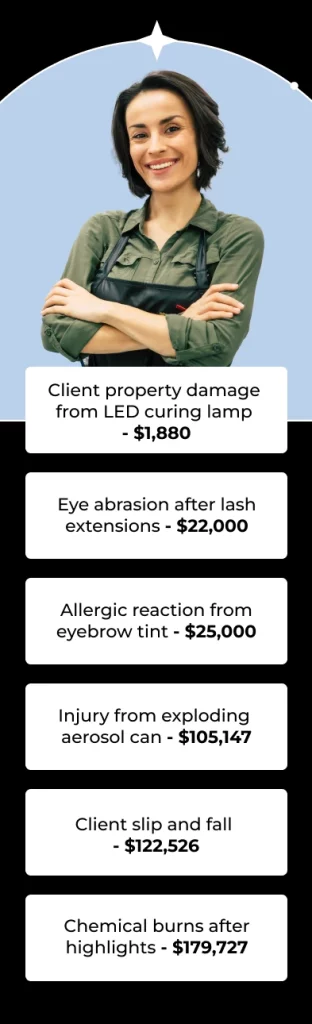

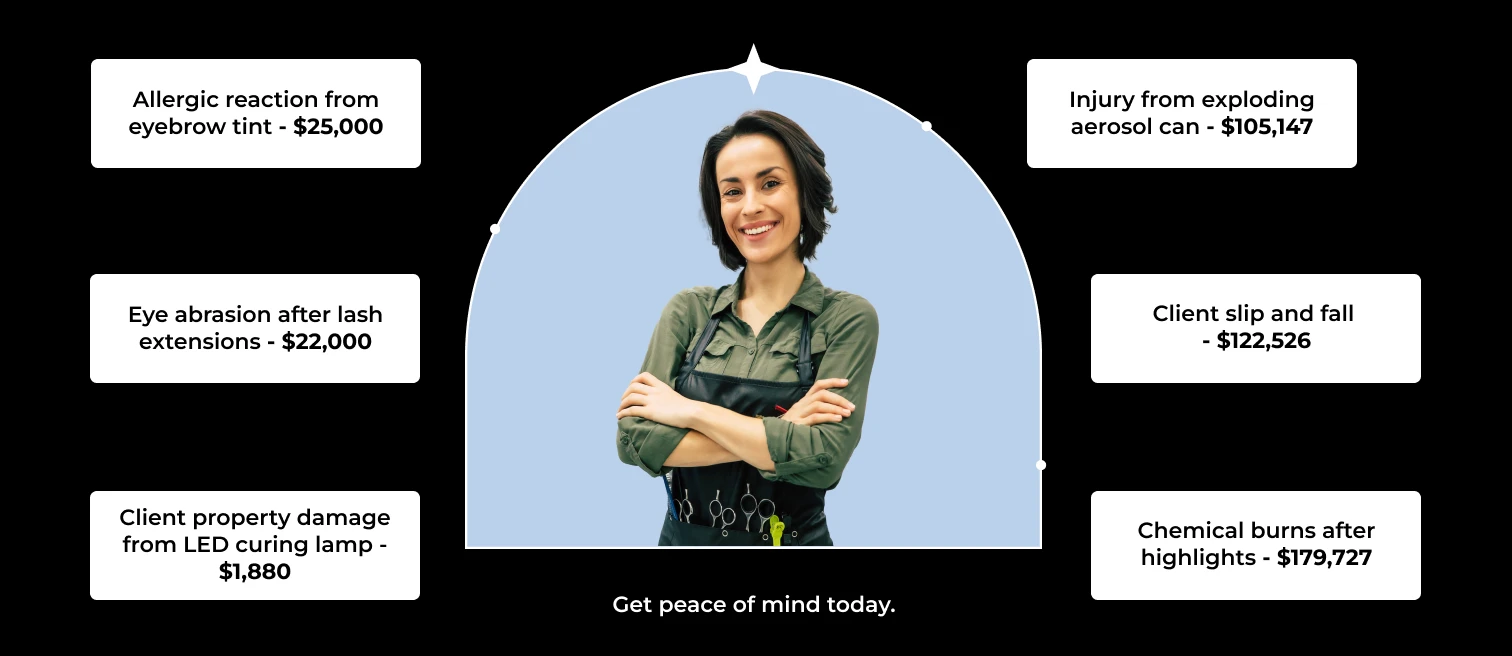

By renting space at a salon or spa, you get the freedom to manage your business. That also means owning the responsibility for risks associated with your work. When things get ugly – and sometimes they do! – paying for damages gets expensive.

BBI’s booth renters insurance gives you peace of mind to work confidently. It’s a must for stylists, estheticians, makeup artists, and others — see why you need insurance if you rent a chair or station in a salon.

Salon and spa owners often require renting professionals to carry liability insurance and list them as additional insureds on the policy. This transfers the risk from them to your insurance provider so that business runs smoothly.

Focus on your craft. We’ve got you covered.

What Does Booth Renters Insurance Cover?

BBI’s insurance coverage for salon booth renters combines general and professional liability coverage into one easy policy.

General liability insurance covers you for things like clients getting hurt or getting their things damaged. Think slip-and-fall accidents in your booth.

Professional liability insurance covers you for anything you do professionally – mistakes during service, recommendations gone awry – even unmet client expectations.

Also wrapped into your policy is coverage for personal and advertising injury, accidental fire damage to your rented space, no-fault medical expenses, and coverage for the products you use and the completed services you provide.

How Much Is Booth Renters Insurance?

BBI’s liability insurance for booth renters starts at just $9.99/month or $96/year!

Build your ideal policy with optional add-ons, such as:

- Additional insureds ($15/per or $30/unlimited): Coverage for your landlord, spa owner, or other relevant third parties.

- Tools and supplies coverage (from $2/month): Multiple coverage options to repair or replace your business essentials in case of damage or theft.

- Cyber liability coverage (from $6.58/month): Coverage in case of cyber attacks on your business.

Learn more about the costs of your policy.

Instant, Quote-Free Process

Get covered in minutes. Over 63,000 professionals like you have found peace of mind with liability coverage from BBI. We think it’s about time you joined us, too!

General and Professional Liability Limits

The most your policy will pay in a 12 month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business and professional services.

$3,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold or distributed.

$3,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

-False Arrest, detention or imprisonment

-Malicious prosecution

-Wrongful Eviction or Wrongful Entry

-Oral or written publications that slander or libels a person or organization

-Oral or written publication or material that violates a person’s right of privacy

-The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

Any One Person: $5,000

i. Please note these are brief definitions of coverage. Your policy may be more restrictive in its language. Refer to the actual policy for a complete description of coverages and exclusions. If you would like to see a sample policy, please contact us.

Breathe Easy

We get it. Accidents happen, but with Beauty and Bodywork Insurance, you’re not alone. While you’re out there caring for your clients, we’ll be here, keeping you protected.

FAQs About Booth Renters Insurance

How Can I Add Additional Insureds to My Policy?

If the salon or spa owner you rent from asks you to list them as an additional insured, you can do that easily through the online application when prompted. If you work at multiple salons with different owners, your best value is to purchase unlimited additional insureds for $30 a year.

If you’re already a BBI policyholder, add additional insureds through your online user dashboard. Under “manage policies,” click “add landlord, employer, event,” then add their information, check out and pay.

Once added, your additional insured will receive an email notifying them of their status!

Does My Insurance Cover Me if I Work at Multiple Locations?

Yes, BBI’s booth renters insurance covers you if you work at multiple locations! Check with each location for their specific insurance requirements – they may ask to be listed as an additional insured on your policy.

What Risks Do I Face as a Booth Renter If I Skip Insurance?

From clients slipping on water to chemical burns from hair dye to claims of false advertising – no matter what your craft or practice is, you face risks every time you step into your booth. Without booth renters insurance, your business and bank account are on the line.

Count on BBI’s comprehensive coverage. (It’s much less expensive than a lawsuit.)

You’re in Great Hands

Here’s what other people have to say about their experience from over 420+ available reviews.

Great comprehensive coverage that conforms to the needs of the home office, studio, atelier and business while also considering health, employees and auto. Great buy! I recommend it to everyone because it’s a very affordable insurance that can be molded to the business’ complexity or simplicity. Amazing!

Working for the first time in three years, I asked a friend about insurance, she highly recommended Beauty & Body work , it was a great site, easy to understand and lots of follow up. Im happy to be working again!

Easy peasy, I think about 6 minutes is all it took and immediately. I had my proof of insurance!

So at ease knowing I have insurance on my new Lash business and it was easy to apply.

Super fast online purchase for my esthetician business...Had a few questions before I purchased spoke with a very helpful associate that doesn't work on commission.

So happy I found Beauty & Bodywork Insurance. The process to insure my spray tanning business was seamless and affordable. Just what I needed!