Massage therapists need a passion for helping others, a license to practice, and a set of trained hands that can put in the work. What else are you missing? The answer is massage liability insurance.

Yes, massage therapists do need insurance. Think of it as an essential oil for your practice, decreasing financial friction when things go wrong.

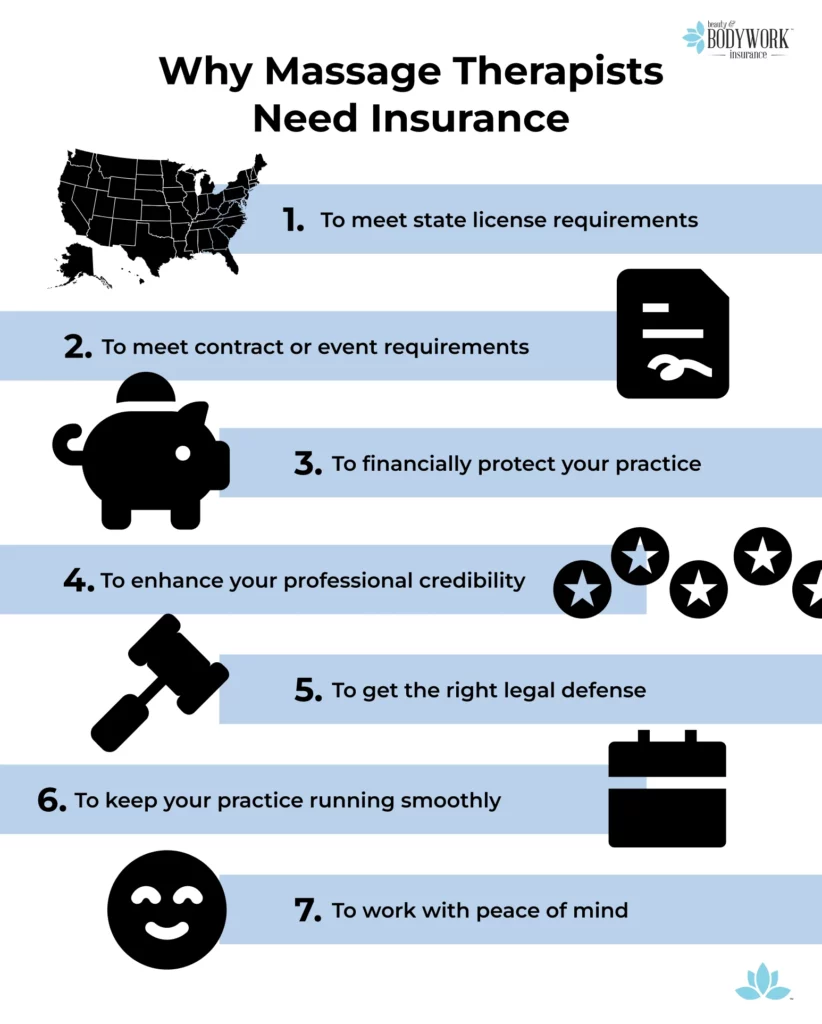

Not convinced? Here are seven reasons why you should get covered now — even if you’re still a student or your employer has insurance.

Why You Need Massage Liability Insurance

Every massage therapist should carry liability insurance. Though your line of work is meant to promote client wellness, there are inherent risks involved that can take a session from relaxing to stressful in seconds.

No matter how much of a pro you are, it’s simply impossible to prevent all accidents, whether real or perceived.

Massage therapy insurance is an essential safety net for your practice, designed precisely for these what-if moments.

Let’s go over each of these reasons further.

1. To Meet State License Requirements

The first reason you need insurance is that your state may require you to carry it to obtain and renew your massage license.

If you live in any of the following states, then you’re legally required to have massage liability insurance to practice.

- Alabama

- Colorado

- Connecticut

- Georgia

- Indiana

- Massachusetts

- Missouri

- New Jersey

- Oklahoma

- South Dakota

- Wisconsin

In these states, you must show proof of insurance when submitting your initial licensure and renewal applications.

Some states are more stringent than others regarding how well they want their massage professionals to be protected. These regulations can change, so be sure to stay up to date on the latest in your area.

For more info, check out our guide on massage state license requirements.

2. To Meet Contract or Event Requirements

Even if you’re not required to carry insurance at the state level, you may find that you still need coverage to meet contract, employment, or event requirements. In other words, you need insurance to be able to work.

- Employment requirements: Some spas and wellness centers require you to carry your own policy, even if you’re an employee.

- Independent contractors: Landlords and businesses often require you to show proof of insurance before they rent space to you.

- Event requirements: Event organizers of wellness fairs, corporate events, or trade shows often require you to show proof of insurance to participate.

- Client contracts: Some corporate or private clients will require proof of insurance before they book you for services.

In all of these scenarios, the other party will typically request that you add them as an additional insured on your policy. This extends your coverage to them in case you are both named in a claim.

3. To Financially Protect Your Practice

Aside from meeting insurance requirements, the most important reason you need massage liability insurance is to financially protect your practice.

If one of your clients were to get hurt during a session, you can be held responsible for paying for their medical bills, rehabilitation, plus your defense costs and any damages awarded. That’s a lot of money — hundreds of thousands, even millions of dollars.

Most massage therapists can’t afford that.

So, by paying a small premium (as low as 26 cents a day!), you can get insurance that would cover these costs should the need arise. This means you won’t find yourself unable to pay to make things right or need to close your practice.

4. To Enhance Your Professional Credibility

Put yourself in your potential client’s shoes. Would you rather see a massage therapist who is uninsured or one who is?

You’d rather see the massage therapist who demonstrates professionalism by carrying insurance, right?

Having massage liability insurance shows that you’re committed to providing a safe experience for your clients and have a backup plan for those just-in-case moments.

Trust is an important factor when it comes to a client’s decision to book. Once you get insured, you can even install an insurance badge on your website or social accounts to build trust and grow your client base.

5. To Get the Right Legal Defense

Accidents happen. But sometimes they don’t. Have you ever thought about how you’d respond if a client claimed you made a mistake even though you didn’t? It’d be their word against yours — and you’d need legal defense to clear your reputation.

When a claim is brought against you, massage therapist insurance can pay to investigate the alleged incident and defend you in court.

You’ve committed hundreds of hours to studying massage therapy techniques, not law, so it’s crucial to have insurance on your side to take care of potential litigation on your behalf.

6. To Keep Your Practice Running Smoothly

One mishap can have a negative ripple effect on your entire practice. Not just on your bank account, but on the time spent away from your clients, your overall well-being, and even your public image — the total opposite of tranquility!

Wrapped into your massage therapist insurance is a special coverage called a medical expense limit. This coverage can pay for your client’s medical bills if they get injured at your practice, even if the injury wasn’t your fault.

It’s designed to quickly get your client the help they need so that the situation doesn’t escalate into an expensive lawsuit. This means you can keep your practice running smoothly without interruption.

7. To Work With Peace of Mind

The final reason why massage therapists need insurance — and perhaps the one you’ll benefit from most in your day-to-day — is that it gives you the ability to work with peace of mind.

Between staying current on the latest industry news and promoting your massage business, you already juggle a busy workload. Worrying about how you’ll manage claims doesn’t have to add to the stress.

With the right coverage, you’re free to practice massage therapy confidently, knowing that you have a safety net if something were to go wrong. This assurance allows you to focus on what really matters: helping clients feel their best.

Massage Risks to Be Aware of

The following risks demonstrate why massage therapists need insurance:

- Client injuries, like strains or bruising, from a session

- Allergic reactions to essential oils, lotions, or other products

- Aggravated pre-existing or undiagnosed conditions

- Slip-and-fall injuries in or around your premises

- Damage to client property caused by your business

- Miscommunication or unmet expectations

- Allegations of improper conduct

- Injuries caused by faulty equipment

Learn more about limiting massage malpractice risks.

Real-World Examples of Massage Injuries

Do massage therapists need insurance? Take it from these real news stories.

Alleged Negligence in Australia

A woman in Victoria, Australia is suing her masseuse and medical clinic for negligence after suffering a stroke, which she alleges was caused by a remedial massage for her sore neck.

The suit has made its way to the Supreme Court of Victoria, and the woman’s masseuse plans to rigorously defend themselves against the claim.

“I am absolutely confident the expert evidence will prove that I did not cause the injuries alleged,” the masseuse is quoted saying.

How Insurance Can Help: In this case of alleged negligence, professional liability insurance can step in to cover the masseuse’s defense and retribution costs if the case doesn’t go their way.

Tragic Death in Thailand

A pop singer in Thailand unfortunately passed away from complications after receiving a Thai massage, which she sought for neck and shoulder pain relief. In a social media post before her death, the singer complained of swelling, bruising, and numbness.

An autopsy is being conducted to determine the exact cause of death, and an investigation is underway to find if the practice adhered to traditional Thai massage technique.

How Insurance Can Help: Like the previous case, if the licensed masseuse has professional liability insurance, that coverage can pay to defend them in court if a case is brought against them.

Hot Stone Burns in Florida

While vacationing in Florida, a woman suffered second-degree burns on her back while receiving her first hot stone massage. The massage therapist did not explain the service adequately nor check in with the woman, who ended up in the emergency room.

How Insurance Can Help: In this particular case, the woman’s lawyer negotiated a pre-lawsuit settlement of $90,000 with the spa’s liability insurer.

Get Covered With Beauty & Bodywork Insurance

Now that you understand the importance of massage liability insurance, why not get covered now? Beauty & Bodywork Insurance (BBI) offers top-rated coverage for professionals like you, starting at just $9.99/month.

Learn More About:

FAQs About Why Massage Therapists Need Insurance

Why Does a Massage Therapist Need Insurance?

Massage therapists need insurance to protect their businesses from claims of client injury, property damage, and more.

Some states require massage therapists to carry liability insurance as a requisite for licensing, and many facilities require independent massage therapists to get covered as a condition for employment.

Can You Practice Massage Without Insurance?

In many states, yes, you technically can practice massage without insurance. However, it is not recommended as it leaves you vulnerable to costly claims that you’d need to take care of on your own. In fact, you’ll likely find it difficult to find work as an independent massage therapist without coverage.

What Type of Insurance Does a Self-Employed Massage Professional Need?

At a minimum, self-employed massage therapists need general and professional liability insurance. These insurance types combined can cover general third-party injury and property damage claims, as well as claims arising from your professional services.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.