Maybe you just found out you need to carry specific types of insurance to apply at your dream salon or spa. Maybe you’re a super-savvy beauty or bodywork professional looking to protect your career and trying to understand the foreign world of insurance – good on you!

But what the heck is the difference between general liability and professional liability insurance?

In just a few minutes, you’ll be an expert on what makes these coverages essential to your business. Be sure to read to the end (there’s a message waiting for you!).

Quick Definitions

➡️ Insurance: An agreement between you and an insurance company that you’ll pay a premium in exchange for financial protection when certain things go wrong.

➡️ Liability: Your legal responsibility to take care of something, such as paying compensation.

What Is General Liability Insurance?

General liability insurance is coverage for accidents that happen while you’re running your business. The keyword here is “general” – so think slip-and-fall injuries, clients’ things getting damaged, or accidental damage to a station you lease.

If a third party (like a client or a passerby) interacts with your business – say they trip on a hot tool cord in your booth – and they get hurt, general liability insurance is what keeps you from having to pay for their medical bills or for an expensive lawsuit.

Accidents like these can be a major financial setback for your business. That’s why carrying this type of coverage is a must.

Under the umbrella of general liability insurance, there are other specific coverages that are often included, too:

- Personal and advertising injury coverage

- Products and completed operations coverage

- Fire legal liability (or “damage to premises rented to you”) coverage

We’ll save the definitions of these for later, though, so we can focus on the big players: general and professional liability coverage.

What Is Professional Liability Insurance?

Professional liability insurance is coverage for what you do professionally as a licensed beauty or bodywork expert.

It’s designed to cover you for claims that you made a mistake in service or gave a recommendation that ended up causing injury. It can even cover you if a client says they’re simply unhappy with their results.

So anything you do as a professional, in the context of your work, could be covered by this type of insurance.

And because your professional services are your livelihood, it’s crucial to get this coverage.

Quick Note: Professional liability insurance, professional indemnity insurance, errors and omissions (E&O) insurance, and malpractice insurance all generally mean the same thing, but there are nuances regarding the type of professional they cover.

General Liability Insurance vs. Professional Liability Insurance: The Key Differences

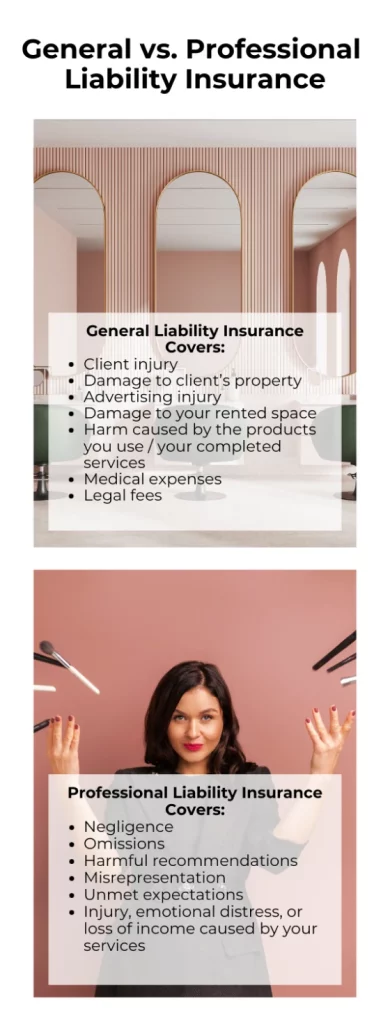

Here’s a chart showing the key differences between general liability and professional liability insurance.

Remember: General liability insurance is for claims arising out of your business operations, and professional liability insurance is for claims that have to do with your professional services.

General vs. Professional Liability Insurance: Example Scenarios

Mariko and the Massage Bed Mishap

Mariko, a licensed massage therapist, was performing a Swedish massage on a client when the massage bed unexpectedly buckled and fell to the floor. Mariko’s client landed in an awkward position that caused a neck sprain. They sued Mariko, claiming that the equipment was not properly maintained.

Claim could be covered by: General liability insurance

Arden and the Lash Glue Allergy

Arden, an experienced lash tech, applied a set of wispy lash extensions on a first-time client. But several hours later, the client called saying she was experiencing an extreme burning sensation in her eye area. The client sued Arden for negligence, claiming that Arden failed to do a proper patch test.

Claim could be covered by: Professional liability insurance

Sage and the Slippery Salon Floor

Hair stylist Sage was welcoming a client into her salon booth when the client slipped on some shampoo suds that had dripped onto the floor by another stylist. Sage’s client fell and fractured her wrist, resulting in a lawsuit against Sage for failing to maintain a safe environment.

Claim could be covered by: General liability insurance

Phoenix and the Hair Color Fail

A client showed Phoenix a photo of the ash-blonde balayage look they wanted. Phoenix got to work, but when they turned their client around for the final reveal, the client lashed out saying the color looked nothing like what they had requested. The client sued Phoenix for failing to deliver and for the emotional distress caused.

Claim could be covered by: Professional liability insurance

Professional vs. General Liability Insurance: How Are They Similar?

Both general and professional liability insurance are designed to provide financial protection in case things go wrong. It’s just the scope of the circumstances covered that differs.

They both can help pay for legal costs, settlement fees, and other damages.

These two main types of coverage can both be required by hiring establishments, event organizers, or clients as a condition for doing business.

The most important similarity between these coverages is that they both offer you peace of mind to work confidently. You won’t have to pay out of pocket when those “oh no” moments happen.

Do I Need Both Coverages?

Short answer: Yes! If you want comprehensive coverage for all the what-ifs, then you need both general and professional liability insurance.

Together, these coverages work to cover you from a wide range of potential risks arising from your physical business and the professional services you offer.

Protecting You From Costly Claims

General liability insurance 🫱🏼🫲🏽 Professional liability insurance

Depending on where you want to work, you might be required to carry both coverages. Salon and spa owners, landlords, or employers often ask for you to show proof of insurance and also add them as additional insureds on your policy.

Both Coverages, One Policy - From BBI

At Beauty & Bodywork Insurance (BBI), we know how important it is for beauty and bodywork pros like you to get the coverage you need. Hey, it’s in our name!

We combine general and professional liability insurance into one easy policy that you can buy online in minutes – no quote, no hoops, just pure peace of mind starting at $9.99/month.

Unlike some insurance companies, our coverage for general and professional liability is occurrence-based. That means you can file a claim for events that happen while you’re covered at any time, even after your policy ends.

With professional insurance, you’re empowered to focus on what matters: helping clients look and feel their best!

A message for you for reading the whole way through:

🎉Congrats!

You officially know the difference between general liability and professional liability insurance. You informed professional, you!

You might also like:

➡️ BBI Benefits You Might Not Know About

➡️ Liability Insurance vs. Malpractice Insurance

➡️ What Is Booth Renters Insurance and Why You Need It

Frequently Asked Questions

We teased it earlier, but in addition to third-party claims of bodily injury and property damage, general liability insurance with BBI also covers:

- Personal and advertising injury: Coverage for non-physical damages, such as libel, slander, copyright infringement, or advertising mistakes.

- Products and completed operations: Coverage for the products you use in service, as well as your completed services after a client leaves your business.

- Fire legal liability: Coverage for accidental fire damage at the space you rent.

Medical expense limit: coverage for medical bills if a client gets injured, whether or not it’s your fault.

BBI’s base insurance policy comes standard with general and professional liability coverage. Depending on your needs, customize your policy by choosing any of our optional add-ons:

- Tools and supplies coverage: Multiple coverage tiers to replace your movable business property in case of damage or theft.

- Additional insureds: Extend your coverage to third parties who require it (like a salon leasing you a station) because they might be affected by claims brought against your business.

- Cyber liability coverage: Get financial protection in case of cyber attacks on your or your clients’ sensitive information.

- Fitness trainer endorsement: Extend your coverage to fitness instruction services, like dance, yoga, or Pilates classes

Liability limits refer to how much money an insurance company will pay out on your policy. There are two types:

- Per occurrence: How much coverage is available per claim filed.

- Aggregate: How much coverage is available for the entire policy year.

BBI’s liability limits (or coverage) are $2 million per occurrence and $3 million in aggregate coverage. That’s the industry standard for beauty and bodywork professionals – at one of the most affordable rates on the market!

Plus, you never have to share this pool of money with other unrelated insureds. (Did you know some other insurance companies make you share? Yikes.)

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.