You’re passionate about helping others. Now it’s time to help yourself — find the best massage insurance for your business, that is!

Understanding aggregates and endorsements can be a challenge, especially when your world usually revolves around wellness. But take a deep breath; this massage insurance guide covers everything you need to know to make an informed decision.

In fact, you can probably read through this and get covered in the next 15 minutes. Just in time for your next client.

Why Massage Liability Insurance Is Essential

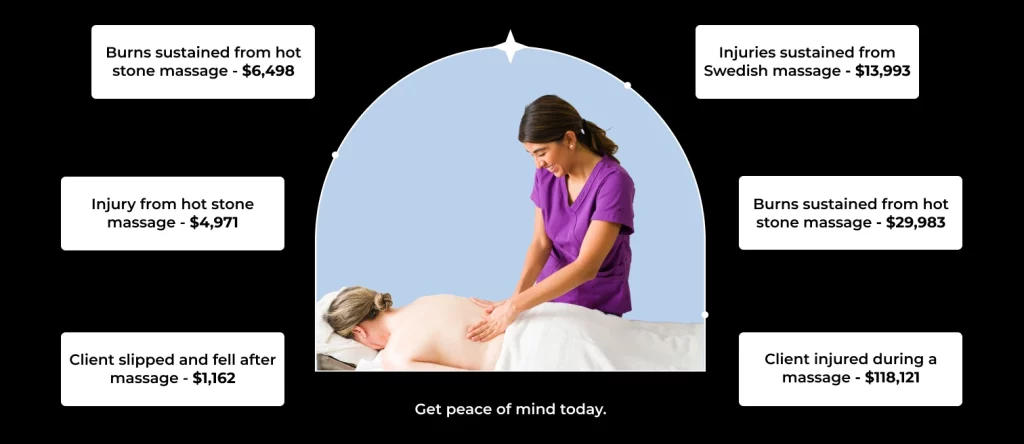

Massage liability insurance saves you from paying thousands of dollars out of pocket for claims and accidents related to your business.

You’ve put in a lot of work to become a licensed massage therapist, so you understand the careful technique that goes into helping clients feel better in their bodies. Despite your expertise, accidents can happen at any time.

When they do, you can be held responsible for paying to make things right. This is where insurance comes in. It’s a financial safety net that protects you when those “what if” possibilities become “oh no” problems.

The second biggest reason you need insurance is because many of the spas, salons, hotels, and other venues where you work require you to carry coverage as a condition for employment. They do this to protect themselves, but ultimately, it benefits you.

The third biggest reason is to give you peace of mind so you can focus on providing the best experience possible for your clients. Rather than worrying about the unique risks you face, you can concentrate on promoting your business or choosing a new aromatherapy candle — the “fun” work!

Quick Recap: Massage liability insurance is important because it:

- Protects you from paying out of pocket when things go wrong

- Helps you meet common employment requirements

- Gives you peace of mind to focus on what matters

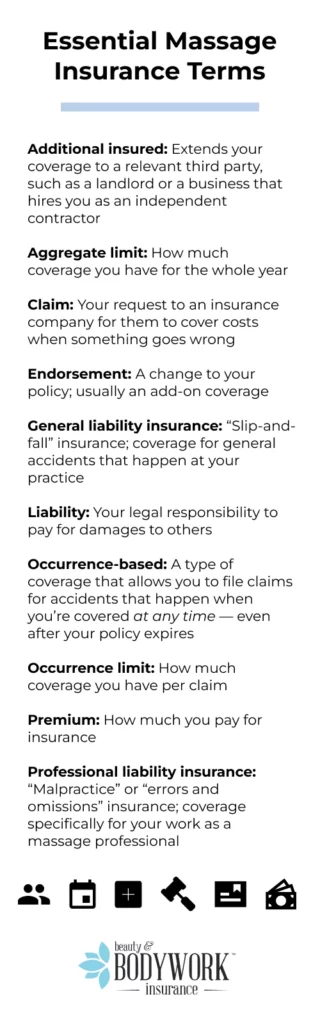

See the full Insurance Glossary.

Massage Therapist Insurance Coverage Explained

The big question: What insurance do I need as a massage therapist?

At a minimum, you need:

- General liability insurance

- Professional liability insurance

General liability insurance is “broad” coverage — like a blanket over your business — while professional liability insurance specifically covers the services you offer as a bodywork professional.

General Liability Insurance

General liability insurance is coverage for accidents that happen to third parties (usually clients) on your business premises. This includes slip-and-fall injuries and property damage caused directly or indirectly by your business operations.

Examples of claims that could be covered:

- A client slipping and falling on massage oil that spilled on the floor

- A client getting hurt after a massage table unexpectedly buckles

- A client’s smartphone shattering after a hot stone accidentally drops on it

Professional Liability Insurance

Professional liability insurance is coverage for bodily injury or property damage caused by the professional services or the advice you offer. If you make a mistake at work — or a client claims you did — this coverage can pay to get everything squared away.

Examples of claims that could be covered:

- You apply too much pressure to a client’s neck and they get hurt

- A client suffers an allergic reaction to an oil and says you were negligent

- A client is dissatisfied with the results of your massage, claiming misrepresentation

General and professional liability insurance protect you from multiple angles. Both are key to a comprehensive massage liability insurance policy.

Other Coverages You Need

- Personal and advertising injury coverage: To pay for claims of non-physical damages, like false advertising mistakes or invasion of privacy

- Products and completed operations coverage: To pay for claims of bodily injury or property damage caused by your completed massage services or the products you use

- Fire legal liability insurance: To pay for repairs or replacement in case of accidental fire in your rented space

- Medical expenses coverage: To pay for client medical bills if they get hurt — whether or not you’re at fault

Quick Tip: Beauty & Bodywork Insurance (BBI) offers liability insurance for massage therapists that bundles general and professional liability insurance, plus all of the above coverages, into one policy — just $96 a year!

Optional Coverages You Might Need

- Additional insureds: Adds a qualified third party — like your contractee, landlord, or event organizer — to your policy so they can also be covered in case of a claim

- Tools and supplies coverage: Pays to repair or replace your movable business property — such as your portable massage table and oils — in case of theft or damage

- Cyber liability insurance: Covers claims of damages — like stolen client data — caused by cyber attacks

- Cupping, microcurrent, or fitness instruction coverage: extends your policy to also cover more specialized services

Quick Tip: BBI offers these coverages as add-on options, or endorsements, to your base policy at affordable rates. For example, adding unlimited additional insureds to your policy amounts to just $2.50/month.

Real-Life Massage Insurance Claims

Neck Pain From Thai Massage

A BBI policyholder in Nevada was helping a client stretch and relax with a 90-minute Thai massage. However, their client later claimed they suffered back and neck pain due to the session.

Our policyholder filed a claim to get their client the care they needed and was able to continue practicing worry-free.

Total Payout: $447,279

Knee Injury From Massage

A BBI policyholder in Florida was performing a massage on a client. The session ended normally, but the client later said they were experiencing a severe knee injury, blaming the massage therapist’s work.

BBI was able to pay for this client’s medical expenses and make things right.

Total Payout: $160,000

Massage Table Fall

Another BBI policyholder in Nevada was welcoming a client into their massage room. While getting onto the massage table, the client fell and injured their wrist when they landed on the floor.

Our policyholder was able to file a claim quickly and assure their client they’ll be taken care of.

Total Payout: $48,062

Types of Massage Therapies Covered

BBI’s massage therapist liability insurance covers most massage therapy modalities and other related beauty and bodywork services.

A single policy covers you for:

- Foot Zoning

- Prenatal Massage

- Trigger Point Therapy

- Myofascial Release

- Craniosacral Therapy

- Plus More!

What This Means: If you buy a BBI professional policy, you’re automatically covered for 250+ services. As long as you don’t practice an excluded method, you’re all set.

How to Choose the Best Insurance for Massage Therapists

The most important factors to consider when shopping for massage liability insurance are coverage, limits, and pricing. If you understand these, you’ll be primed to find the policy that’s right for you!

Before you start comparing, be sure to:

- Check if massage liability insurance is required by your state. If so, what coverage and limits are required?

- Are you being prompted to get covered to work as a contractor? Check if the facility or event requires you to add them as additional insured. (Likely, yes!)

Coverage

Coverage refers to which exposures (risks) are “covered” by the policy. This affects you in two ways:

- If the policy covers the specific massage therapies you practice (i.e. Swedish, deep tissue)

- If the policy includes the coverage types you need (i.e. general and professional liability, tools and supplies)

An ideal massage insurance policy will include general and professional liability insurance, as well as coverage for multiple massage modalities.

BBI’s Massage Insurance

✔️ Base policy includes general and professional liability insurance

✔️ Customizable coverage with optional add-ons

✔️ Coverage for most massage modalities (250+ services!)

✔️ Occurrence-based coverage*

*All new policies purchased after July 1, 2024 include occurrence-based coverage.

Limits

The limits of a massage insurance policy refer to how much insurance money is available to you when you need it.

There are two limit types you need to know:

- Occurrence limit: The maximum amount the policy can pay for a single claim

- Aggregate limit: The maximum amount the policy can pay for the entire policy year

The industry standard for massage insurance is a $2 million occurrence limit and a $3 million aggregate limit.

For example, if you have a claim worth $1 million (which is under the $2 million occurrence limit), you’d still have $2 million in aggregate coverage ($3 million total) for the rest of the year.

Policy limits should not be too low (not enough coverage) or too high (increases your cost unnecessarily) — and they should not be shared.

BBI’s Massage Insurance

✔️ $2 million occurrence limit

✔️ $3 million aggregate limit

✔️ 100% individual limits — never shared amongst policyholders

Price

Another important factor to consider is the cost of the insurance premium, or how much you pay to get covered.

Massage insurance policies range from about $170 yearly to upwards of $235. Some of these options are association-based, so the cost of insurance is bundled with a membership fee. That means you end up paying for more than just insurance — whether that’s worth it is up to you.

Some other things that can affect cost include:

- Your experience as a massage therapist

- The number and type of services you offer

- Your location and the type of space you work out of

- If the policy includes coverage you don’t need

- If the policy offers monthly or annual payment options

BBI’s Massage Insurance

✔️ Starts at $96/year

✔️ Transparent pricing

✔️ No membership fees

✔️ Flat rate for all massage therapists

✔️ Monthly and yearly payment options

✔️ Pay only for add-on coverages you need

Other Considerations

Finally, some other considerations to solidify your decision are convenience, customer reviews, and additional benefits.

- Can you purchase your policy instantly online?

- Can you manage coverage and file claims online?

- Does the customer team work on commission?

- Are the customer reviews positive?

- Are there any additional benefits?

BBI’s Massage Insurance

✔️ Fast online purchase

✔️ Online user dashboard

✔️ Easy-to-file claims process

✔️ Licensed, non-commissioned support team

✔️ Extra benefits to grow your practice

Get Covered Now With BBI

Ready to work with peace of mind? You can get your BBI policy in just a few clicks.

- Head over to our online application.

- Select your services.

- Add on any extra coverages.

- Tell us about your business.

- See your instant quote and check out.

Massage Insurance Guide FAQs

Do I Need Insurance if I Work for Someone Else?

Yes! Even if your employer offers liability insurance, it’s essential to carry your own policy to fill any coverage gaps. Plus, this gives you the freedom to work at multiple locations, knowing your coverage follows you wherever you work.

What Happens if I Don’t Have Insurance and Something Goes Wrong?

If you don’t have massage liability insurance and something goes wrong, you will likely be responsible for paying for damages on your own. This can include your client’s medical expenses and legal or settlement fees, which can amount to thousands — even millions — of dollars.

Is Insurance Required in All States?

Not all states require LMTs to carry insurance, but most states highly recommend coverage. Even if your state does not require you to carry insurance, it’s essential for financially protecting your practice and giving you peace of mind to work with confidence.

What Are Shared Limits?

Some insurance companies make their policyholders share coverage limits — and it’s exactly how it sounds. If someone you don’t even know has an exceptionally large claim payout, this depletes the funds for everyone on the policy, potentially leaving you with inadequate coverage.

BBI believes coverage limits should be your own, so you don’t have to worry about shared limits with us!

Is Claims-Made or Occurrence-Based Coverage Better?

Occurrence-based coverage is generally preferred because it gives you the flexibility to file claims whenever the need arises. So long as the incident happened while your policy was active, you can file a claim even years after!

More Resources for Finding the Right Massage Therapist Insurance Coverage

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.