Your massage therapy practice supports clients’ wellness and relaxation — but what’s not so calming is everything that can go wrong during or after a session. Even experienced bodywork professionals face risks daily, and those risks can lead to costly mishaps.

So, what kinds of situations do massage therapists actually deal with? Let’s break down the most common massage therapy claims, plus real payout numbers (ahem, $400K!) to show what’s truly at stake.

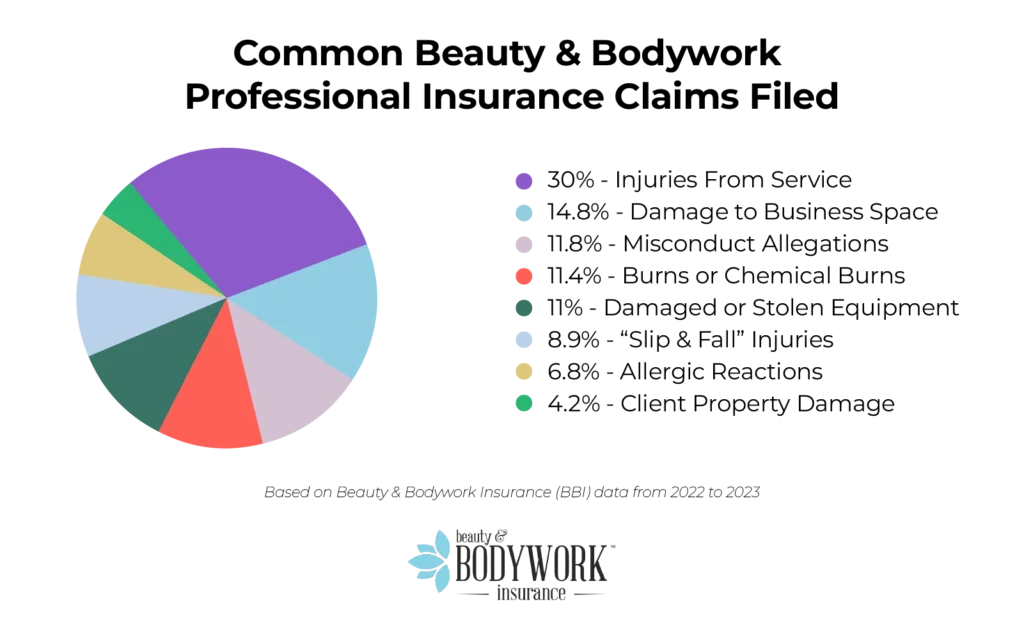

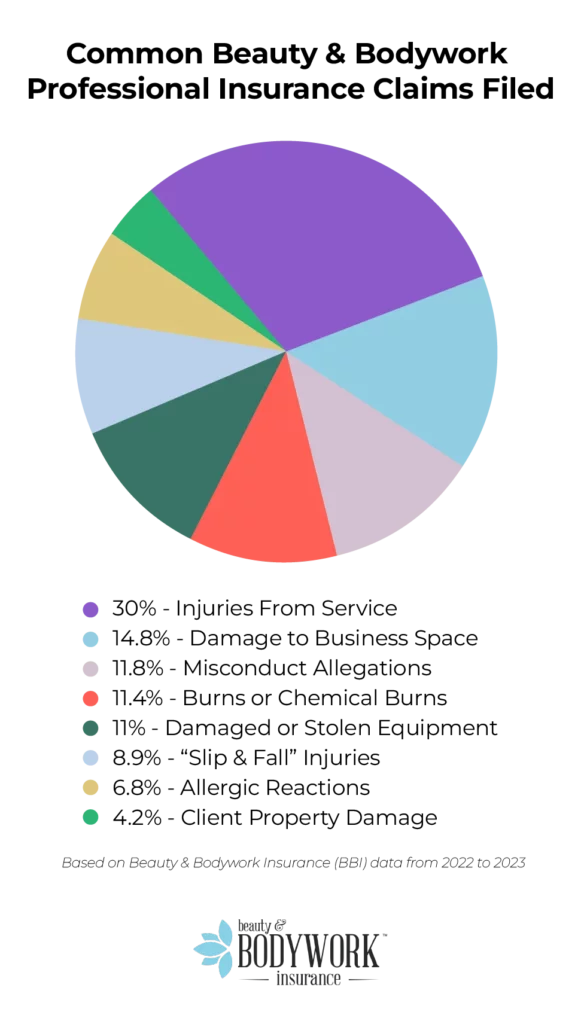

The Most Common Massage Therapy Claims

Slip-and-Fall Injuries

Slippery massage oils. The distance between your massage table and the floor. Clients feeling ultra-relaxed after a session. When you consider the potential hazards in your workspace, it’s easy to see how general injuries to third parties (usually your clients) can occur.

These are indirectly caused by your business operations and are most commonly seen when clients get on or off the massage table. Yes, this simple act gone awry can lead to a claim worth thousands.

🛡️ Could be covered by: General liability insurance

👉🏻 Third party: Anyone other than you, your employees, or your insurance company (i.e. clients, passersby)

Property Damage

Your massage practice can inadvertently cause damage to your client’s things. How? Say a client comes in with a vintage leather bag, and you accidentally spill massage oil on it. Or, during an in-home session, your portable massage table knocks over an expensive art piece.

If this happens, your client may hold you responsible for repairing or replacing their beloved items.

🛡️ Could be covered by: General liability insurance

Service-Related Injuries

A common massage therapy claim is injury caused by your professional services. Of course, you take great care to listen to your client’s needs and adjust accordingly, but sometimes your work may lead to excessive soreness, bruising, or nerve damage.

Another possibility is aggravating a pre-existing condition or a prior injury.

You never want to hear that you “made a mistake” from a client, especially with how seriously you take your work, but it’s crucial to prepare for situations like these.

🛡️ Could be covered by: Professional liability insurance

Damage to Business Space

From candles to faulty towel warmers, there’s the risk of accidental fire occurring in your rented massage space. If an accidental fire breaks out at your business, you can be held responsible for paying for repair or replacement bills.

Lease contracts with landlords typically require tenants to carry liability coverage to protect against potential claims like this. With good reason — fire is one of the most common causes of property damage. If you’re not properly insured, you could be out thousands of dollars to restore your rented space.

🛡️ Could be covered by: Fire legal liability coverage

Misconduct Allegations

It’s no secret that the massage industry is marred with allegations of inappropriate conduct and sexual abuse. Most massage therapists — including you — are trustworthy, honest professionals who genuinely care about helping clients feel better. But a few bad seeds can cause distrust in your work.

Even if you’ve done everything right, but a client perceives that you acted improperly, you can face a claim caused by:

- Misinterpretation of a technique

- Exposure during a draping shift

- Lack of clear communication

- Individual levels of comfort

- Different cultural norms

A single complaint can wreak havoc on your practice’s reputation, so it’s essential to uphold the highest standard of professionalism at all times and protect yourself with the right coverage.

🛡️ Could be covered by: Sexual abuse and molestation insurance

Allergic Reactions

From essential oils to laundry detergent, there are many ingredients in the products you use that cause allergic reactions in clients. Your client could be unaware they’re sensitive to allergens like latex or tea tree oil, and even with proper patch testing, an allergic reaction may not appear until days later.

Allergic reactions, such as contact dermatitis, can:

- Show a delayed response

- Develop after repeated exposure

- Be triggered when combined with other products

- Be triggered after product use on the entire body (versus a small patch test)

Educate yourself on common allergens and dilute essential oils in carrier oils properly, but be aware that some allergic reactions can be entirely out of your hands.

🛡️ Could be covered by: Products and completed operations coverage

Burn Injuries

Another common massage insurance claim is burn injuries caused by excessive heat from:

- Hot stones

- Heating pads

- Heated massage oils

- Hot towels

Warmers can malfunction or a client may be more sensitive to heat than others. If you accidentally cause a burn injury during service, your client may take legal action and hold you liable for their medical bills and rehabilitation fees.

🛡️ Could be covered by: Products and completed operations coverage

Damaged or Stolen Equipment

The final massage therapy claim your peers most commonly face is theft or damage to business personal property, which is any movable tool or equipment used for work. This includes things like your portable massage table, your oils and creams, and business tablet.

Say you work from multiple locations and transport your massage essentials in your car. When you stop for gas, your entire kit is stolen from your locked trunk, leaving you unable to fulfill your next appointments.

You spend a lot of money checking off your massage therapy equipment list. Protecting your investment — like your $500 massage table! — is smart in case of unforeseen loss.

🛡️ Could be covered by: Tools and supplies coverage

Real Massage Insurance Claims BBI Customers Faced

Real scenarios, real numbers. Here are some actual claims* BBI has helped massage therapists with.

Mobile Trip-and-Fall

One of our insured massage therapists in Georgia was operating their mobile massage business as usual when a client tripped and fell while entering the bus. Unfortunately, the client suffered facial injuries and demanded financial support for their medical treatment.

💵 Total Payout: $39,649

Hot Stone Burn

A client in Florida was treating themselves to a hot stone massage on a self-care day. However, they noticed the stones were much too hot upon application and suffered burns on their neck. They made a claim against our policyholder over the injury.

💵 Total Payout: $45,000

LMT Trip-and-Fall

One of our massage therapists in California was setting up for a session but didn’t notice a small puddle of water on the floor left behind by the condensation on their previous client’s beverage. Our policyholder tripped, fell, and landed on their client’s face, causing several fractures.

💵 Total Payout: $110,000

Ruptured Implants

A client in Oklahoma was enjoying a total-body massage from one of our insured massage therapists one day. However, the client claims that, due to the pressure applied to her chest, her breast implants ruptured, which caused painful swelling and required surgical removal.

💵 Total Payout: $172,179

Swedish Massage

One of our policyholders was performing a Swedish massage on a client. Everything was going smoothly; however, the client later alleged that the massage she received caused a series of strokes due to a carotid artery dissection (a tear in an artery near the neck).

💵 Total Payout: $398,895

BBI helped these massage therapists get the help they needed to make things right with their clients!

👉🏻 Did You Know? BBI’s average payout since 2022 to defend a beauty or bodywork professional claim is $19,091.

✨ Learn More: Why Massage Therapists Need Insurance

*The claim scenarios presented are based on real insurance claims; however, certain details have been modified or fictionalized for editorial purposes. These examples are intended for informational use only and should not be interpreted as exact representations of specific cases.

How to Prevent Massage Therapy Claims

Here are a few ways to decrease your chances of facing common massage claims.

- Communicate clearly: Check in with clients to ensure they are comfortable during service and understand what you’re doing. This reduces the chances of misinterpretation. Make sure they know they can and should speak up if they’re uncomfortable or in pain.

- Take detailed notes: Document each session — write down what you worked on, what was communicated, and your client’s overall demeanor. These notes can assist in protecting you if you’re ever threatened by a potential false claim.

- Maintain professional boundaries: Keep it professional at all times. Before, during, and after service, in-person or through messaging, limit your interactions to a professional context to avoid misunderstandings.

- Stay within scope: You’re trained as a licensed massage therapist (LMT) — don’t act or give recommendations outside of the scope of your practice.

- Carry liability insurance: Carrying the proper massage liability coverage — and displaying your proof of coverage to clients — builds professional credibility and signals to your clients that you care about keeping a safe, professional practice!

✨ Learn more about limiting massage malpractice risks.

Types of Insurance Coverage Massage Therapists Need

Here are the main types of insurance coverages you need.

General Liability Insurance

General liability insurance protects you from claims of third-party damages, such as your clients getting hurt or having their property damaged due to your business operations. Think general indirect mishaps — anything that can go wrong from someone interacting with your physical business space.

Professional Liability Insurance

Professional liability insurance specifically focuses on what you do as a professional — your bodywork services. If a client suffers any kind of harm because of your work or recommendations as a massage therapist, this coverage is designed to kick in and protect your business.

Tools & Supplies Coverage

Tools and supplies coverage is an optional coverage that pays to repair or replace your business property (as long as it’s not permanently installed) in case of damage or theft. This ensures your practice keeps running smoothly if anything happens to your necessary tools.

Cyber Liability Coverage

Cyber liability coverage is another optional coverage that can help you recover if your practice is subject to cyber attacks, like client data theft.

Specialization Endorsements

Additional Coverages

- Personal and advertising injury coverage: Covers non-physical injuries, like libel, slander, or damages from advertising mistakes

- Products and completed operations coverage: Covers the products you use (like massage oils) and the services you provide (such as a massage) after you’ve completed a session, if they accidentally cause harm to a client

- Fire legal liability coverage: Pays to repair accidental fire damage in the space you rent

- Medical expense limit: Pays for client’s medical bills if they’re injured at your business — even if it’s not your fault

Additional Insureds

Looking for work as an independent contractor? You’ll likely be asked to add the business, landlord, or venue as an additional insured to your policy. This means they are also insured by your policy — so if they’re ever named in a claim made against you, they’re covered!

This is common in the bodywork industry; it helps protect both parties and alleviates some of the risk of taking you on as an independent contractor.

What to Do if a Claim Is Filed Against You

- Stay calm and professional, but don’t admit fault.

- Notify your insurer immediately. With BBI, you can file a claim in a few minutes. A real person will contact you to walk you through the next steps.

- Gather documentation, such as client intake forms, session notes, waivers, and relevant communication.

- Cooperate with your insurer as they investigate and answer any questions they might have.

- Limit your communication with the client until a resolution is reached.

Having a claim brought against you is a stressful experience. BBI is here for you when it matters — you won’t have to go through the process alone or uninformed. We’ve got you covered from cart to claim

FAQs About Common Massage Claims

Will Massage Liability Insurance Cover Me Against All Claims?

Massage liability insurance covers many common risks, but it may not cover claims involving gross negligence, intentional harm, or services outside your scope of practice. Always review your policy to understand exclusions and limits.

What Should I Do if a Client Threatens to Sue?

If a client threatens to sue, calmly let them know that you’re willing to work with them to make things right. If they suffered a physical injury, BBI’s medical expense limit can cover their medical bills up to $5,000 per person. This is designed to quickly get them the help they need and potentially prevent litigation.

However, if the situation escalates, notify your insurer immediately and follow their guidance for proper handling of the claim.

The Spa Where I Work Has Insurance. Am I Covered?

You may be covered under the spa’s policy, but their insurance primarily protects the business — not you personally. Having your own policy ensures you’re protected if a claim is filed against you individually.

Does Homeowner’s Insurance Cover Me if I Work From Home?

Most homeowner’s insurance policies do not cover business-related claims, including client injuries or professional liability. You need a separate massage liability policy to ensure proper coverage.

Is Massage Therapist Insurance Worth It?

Yes, insurance helps protect your career and finances from costly claims, no matter how careful you are. Without coverage, you could be personally responsible for legal fees and damages.

BBI’s massage liability coverage starts at just $96 a year. The tradeoff for working with peace of mind amounts to about 27 cents a day!

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Beauty and Bodywork Insurance. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.