Occurrence-Based Policy

An occurrence-based policy covers claims for incidents that happen during a policy period — even if the claim is filed after the policy ends. This type of coverage is preferred across the beauty and bodywork industry because it offers long-term protection for your business.

With BBI’s occurrence-based coverage*, get peace of mind knowing you have help with costly claims even if your policy period has ended. Yep, we like supporting you like that.

*If you purchased your policy after July 1, 2024, your policy is an occurrence-based policy. If you purchased or renewed your policy before July 1, 2024, your policy is a claims-made policy and will be eligible to become an occurrence-based policy after July 1, 2025.

Occurrence Policy vs Claims-Made Policy

We explained that an occurrence policy offers coverage for losses that happen during your policy, regardless of when the file is claimed. So what is a claims-made policy?

A claims-made policy only covers claims that are filed during the policy period. But, it can get a little more complicated. Claims-made policies sometimes include a retroactive date and an extended reporting period.

The retroactive date dictates when coverage actually starts, which could be the policy’s effective date or earlier. And the extended reporting period, as the name suggests, extends the time allowed for reporting.

Occurrence Policy

- File during or after your policy period

- Long-term protection for events occurring during your policy period

Claims-Made Policy

- File only when your policy is active

- Options for retroactive date and extended reporting period

The Benefits of Occurrence-Based Insurance

Let’s go over some of the main benefits of occurrence-based coverage with BBI.

Long-Term Protection

The biggest advantage of having an occurrence policy is the ability to file claims for events that happen during your policy period — at any time.

Say you bleached a client’s hair to achieve their dream color, and a year later, they claim you inflicted chemical burns on their scalp. It happens! Or, imagine a massage client suing you for persistent back pains years after you last saw them — and years after your policy expired.

Occurrence-based policies cover claims like these.

Annual Reset of Limits

Your policy has two types of limits: occurrence, which is the maximum amount that’ll be paid per claim, and aggregate, which is the maximum amount that’ll be paid per policy year.

With occurrence-based coverage, these limits reset each year you renew. That means if you receive a claim payout for one year that nearly reaches the aggregate limit, and you have to file another claim for something that happened in that first year, you’d still have a new set of aggregate limits from the next year to help you pay for that claim.

Phew! As long as you renew your occurrence policy, you’ll have peace of mind that you have adequate coverage for any claims that come your way.

Pricing

Because occurrence-based policies extend your filing period indefinitely, they are often more expensive. Why is this listed as a benefit? Well, it’s because BBI’s professional policy offers occurrence coverage at a more affordable price than others on the market.

With BBI, the tradeoff for lifelong peace of mind starts at just $9.99/month.

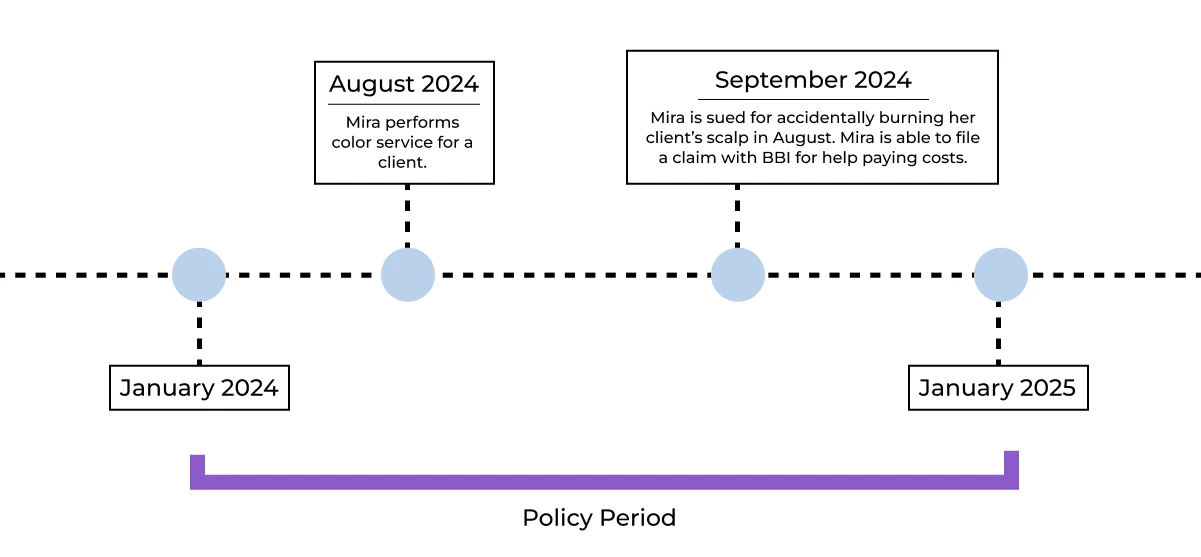

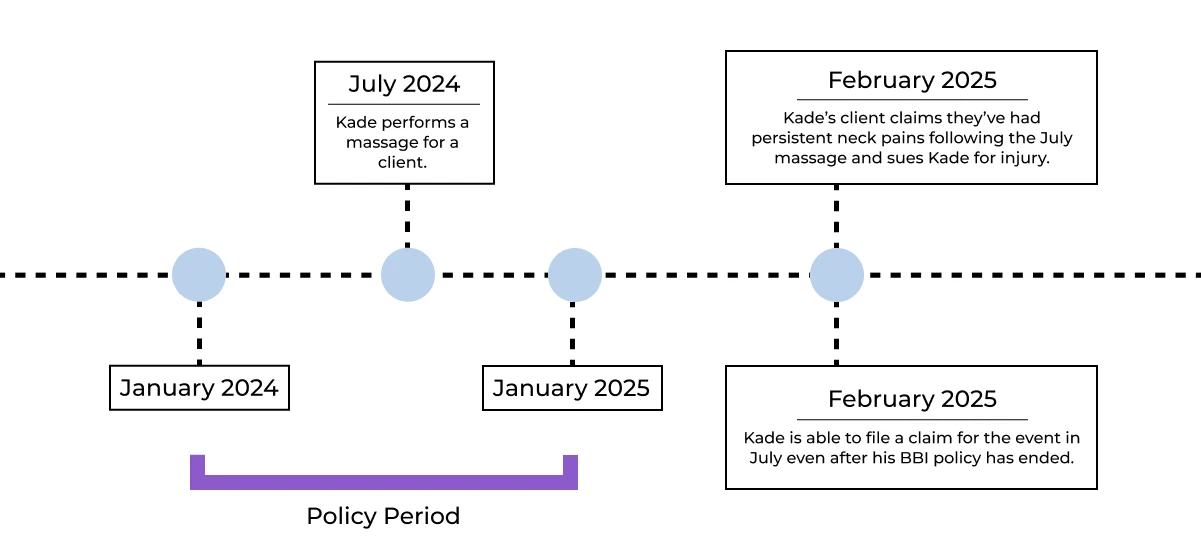

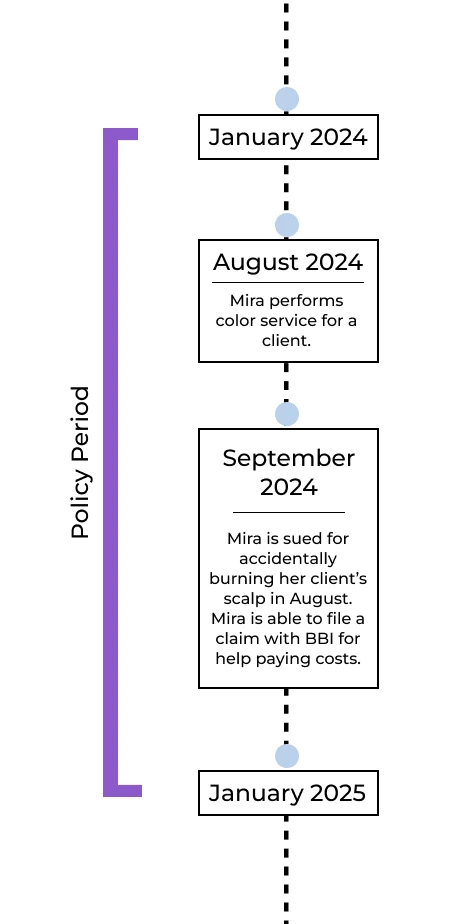

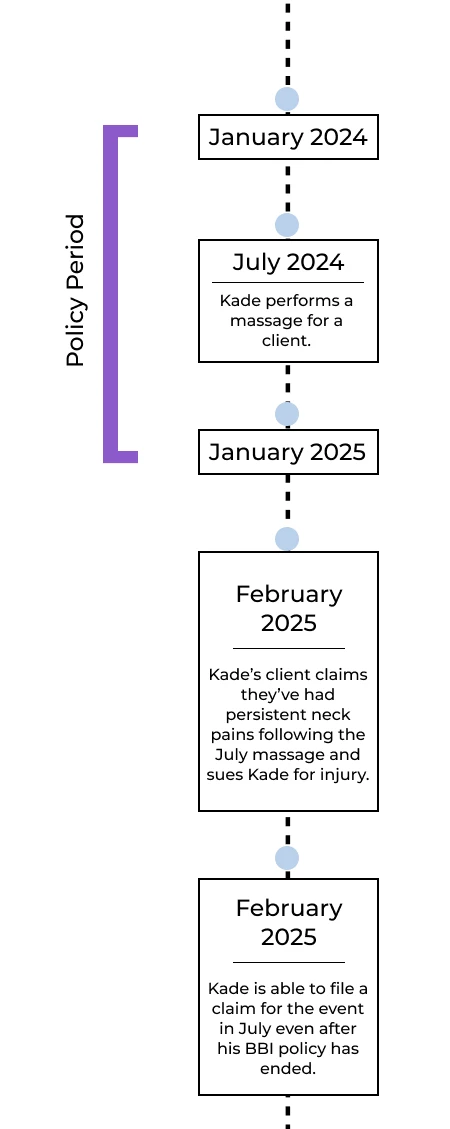

Examples of Occurrence-Based Policy Timelines

Check out these examples to see how an occurrence-based policy timeline could look.

Note that in both examples above, the qualifying incident occurred during the policy period. With occurrence insurance, Mira and Kade can file claims because they were both covered when their respective events happened.

Examples of Occurrence-Based Policy Timelines

Check out these examples to see how an occurrence-based policy timeline could look.

Note that in both examples above, the qualifying incident occurred during the policy period. With occurrence insurance, Mira and Kade can file claims because they were both covered when their respective events happened.

Ready to Get Covered?

Now that you know the basics of occurrence coverage, it’s time to protect your beauty or bodywork business. Get industry-preferred occurrence insurance with BBI today.

Over 63,000 professionals like you already enjoy:

- Top-rated insurance carriers

- High-coverage limits at low costs

- Easy online policy management

- Individual limits you never have to share

- Coverage that goes where you go

- Monthly or annual payment options

- And much, much more!

Frequently Asked Questions

What Is an Occurrence-Based Policy?

An occurrence-based policy is an insurance policy that covers claims for incidents that occur during the policy period, regardless of when the claim is filed. This type of policy is also called an “occurrence policy” or an “occurrence-form policy.”

What Is the Difference Between Claims-Made and Occurrence Insurance?

The main difference between a claims-made policy and an occurrence policy is the window during which a policyholder may file a claim. A claims-made policy only covers claims for events that happen and are filed while the policy is active. An occurrence policy covers claims for events that happen during the policy period — even after the policy ends.

What Are the Advantages of Occurrence-Based Policies?

The main advantages of an occurrence-based policy are:

- Long-term protection for your work during your policy period

- Peace of mind knowing you’re covered for an insured period

- Annual resetting of liability limits when you renew your policy

Is There a Limit to How Long After an Incident I Can File a Claim?

If you have an occurrence-based policy, no, there is no limit to how long after an incident you can file a claim.

What Is the Policy Period for an Occurrence Policy?

The policy period for an occurrence policy is the time between the policy effective (start) date and the policy expiration (end) date, which are stated on your Certificate of Insurance (COI).

For example, suppose your policy’s effective date is January 1, 2025, and its expiration date is December 31, 2025. In that case, you are covered for events that happen within this one-year policy period and can file claims for these events even after December 31, 2025.

Reviewed by:

JoAnne Hammer | Beauty & Bodywork Insurance Program Manager, Certified Insurance Counselor

With 29 years of experience in the small business insurance world, JoAnne knows her stuff. She reviewed this page and gave it her stamp of approval, so you can feel confident this info’s been vetted by a true expert.

You're in good hands.

Here’s what other people have to say about their experience from over 420+ available reviews.

Great comprehensive coverage that conforms to the needs of the home office, studio, atelier and business while also considering health, employees and auto. Great buy! I recommend it to everyone because it’s a very affordable insurance that can be molded to the business’ complexity or simplicity. Amazing!

Working for the first time in three years, I asked a friend about insurance, she highly recommended Beauty & Body work , it was a great site, easy to understand and lots of follow up. Im happy to be working again!

Easy peasy, I think about 6 minutes is all it took and immediately. I had my proof of insurance!

So at ease knowing I have insurance on my new Lash business and it was easy to apply.

Super fast online purchase for my esthetician business...Had a few questions before I purchased spoke with a very helpful associate that doesn't work on commission.

So happy I found Beauty & Bodywork Insurance. The process to insure my spray tanning business was seamless and affordable. Just what I needed!